To Woodforest National Bank, “relationship banking” is everything. As one of the strongest community banks in the USA, they are well known for their hundreds of retail branches located within prominent operators of big box retail and grocery stores. In addition to 700 branches in 17 different states, their electronic payments line of business includes a multi-vendor fleet of 850+ ATMs and payment card issuance platforms.

With a growing number of customer transactions shifting to cards and the ATM self-service channel, Woodforest wanted to optimize the health of their electronic payments ecosystem. The Bank chose real-time transaction data specialists, INETCO, to provide a real-time monitoring, analytics and data streaming solution that would allow Woodforest to gain one-stop, 24X7 visibility into

- Every customer transaction taking place across a multi-vendor fleet of 850+ ATMs

- Every payment card transaction that is submitted to Woodforest by one or more authorized payment networks or other third parties

“Whether it is front line operations, the secondary support teams doing research, or our business teams looking for a better understanding of card usage or ATM channel performance, INETCO’s real-time transaction data platform has positively impacted us all,” says Scott Haney, Vice President of Corporate Operations for Woodforest National Bank. “Woodforest has been able to take a multi-faceted approach to real-time transaction intelligence. This data strategy has measurably paid off in terms of operational efficiency, customer experience and branch profitability.”

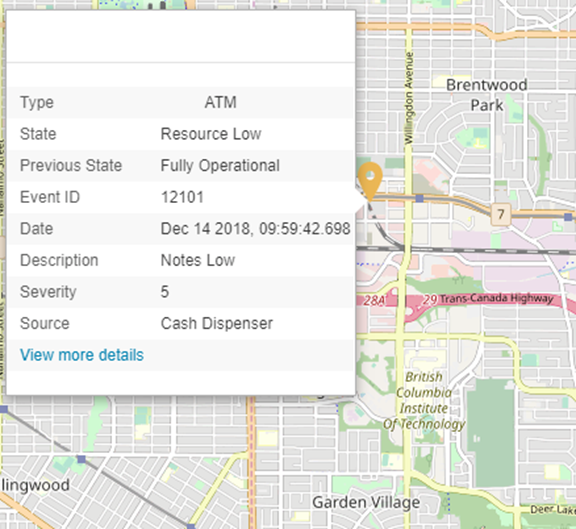

Built specifically for banking and payments environments, INETCO Insight captures real-time transaction data and decodes a wide variety of packaged and customized protocols, including XML, SQL, ISO8583, and those specific to ATMs of major ATM manufacturers. The network, metadata and application-level payload information is completely parsed out for every transaction, making it easy for Woodforest to access the various message fields, response/request timings and network communications data contained within every transaction. Customizable, rules-based alerts are created to help Woodforest quickly identify when there is:

- A lack of communication between ATMs or card systems and the back-end authorization systems

- A change in an ATM device state related to operational performance or cash levels (i.e., out of cash/low on cash)

- A disappearance of specific transaction links or network/third party connections

- An unexpected authorization decline, or an increase in transaction duration rate

- A lack of activity on specified ATMs or related systems during peak hours

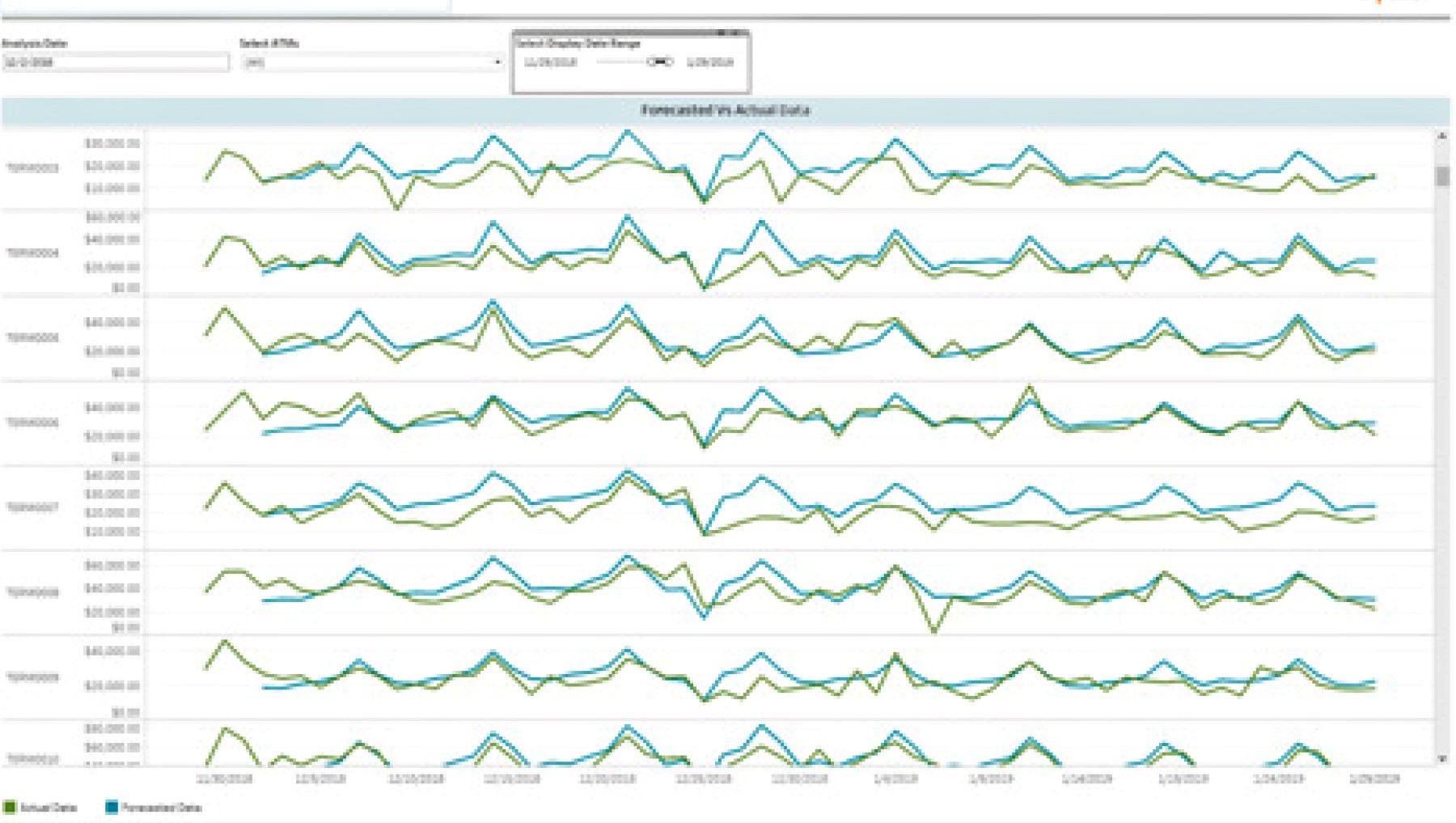

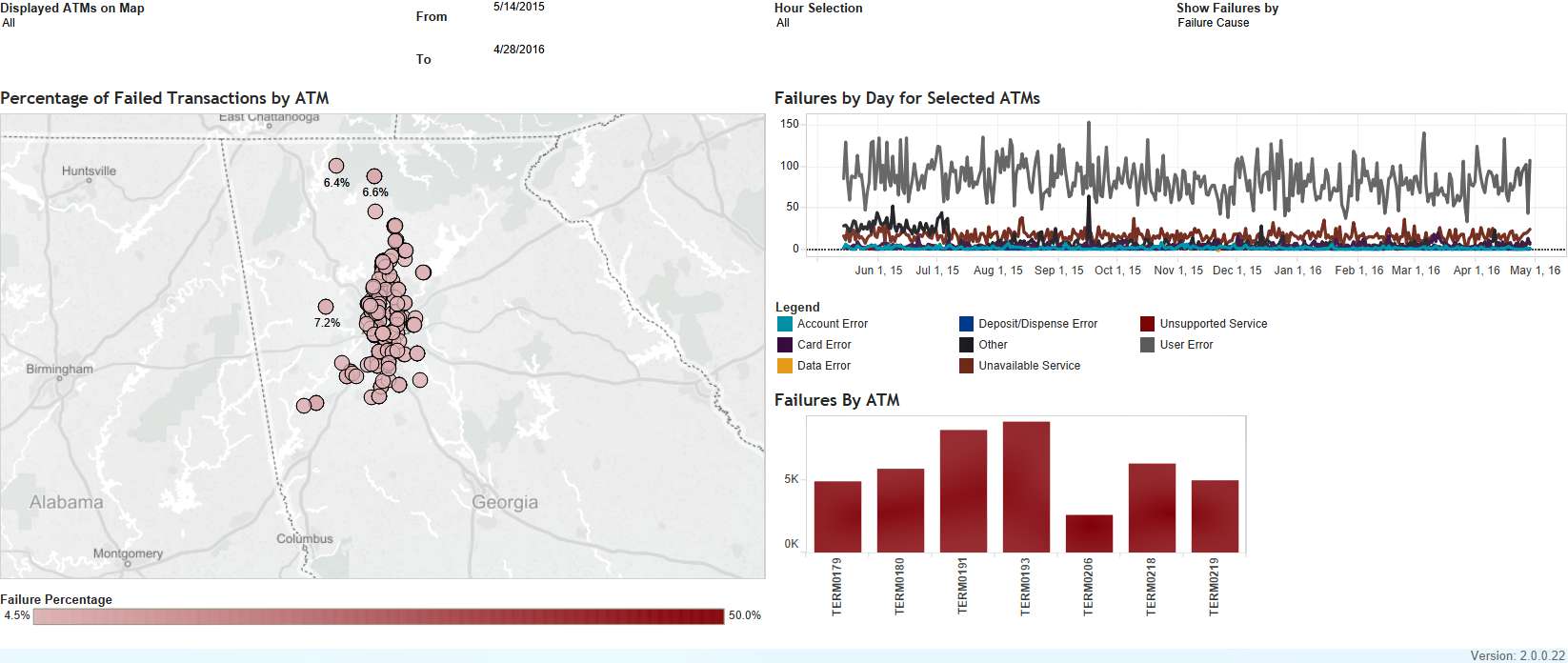

Woodforest’s transaction intelligence is stored within a scalable open source database, and forwarded to INETCO Analytics for on-demand visualization, reporting and analysis of:

- Availability — What is the up-time of each individual ATM machine?

- Profitability — What is the profitability of the ATMs located at each branch location?

- Cash forecasting and replenishment — How many deposits, and how much cash, is utilized at each individual ATM location?

- ATM placement — When does deposit activity and transaction volume data indicate it is time to re-evaluate whether one full service/one cash dispenser ATM per branch location is the right combination?

- Card usage — Where are card transactions being acquired from?

With the implementation of INETCO solutions, Woodforest has been able to improve operational efficiency and promote fact-based decision making down to the branch level. The Bank believes that rich transaction intelligence has also helped them drive more business and improve branch profitability by:

- Maximizing the availability of their ATMs

- Remediating transaction performance issues before customer service is significantly impacted

- Performing profitability analysis on every ATM

- Improving cash forecasting and replenishment at the individual ATM level to reduce both idle cash and ATM cash-out scenarios

For more information on how Woodforest National Bank is using INETCO Insight and INETCO Analytics to improve branch profitability and the customer experience, you can read the full case study, or contact me directly.

English

English French

French Portuguese

Portuguese Spanish

Spanish