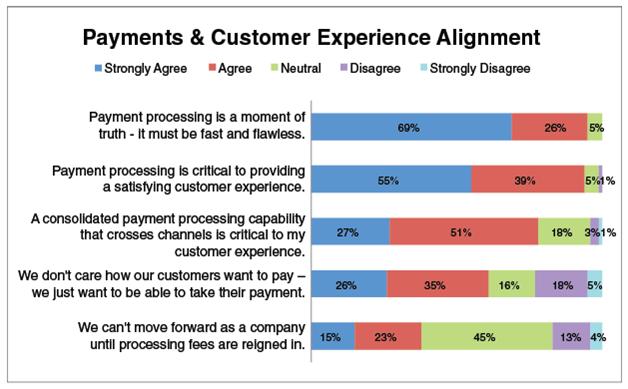

Earlier this week, Retail Systems Research (RSR) released a Fast Fact titled, “Retail Payments and the Customer Experience: Waiting for Processors”. It was taken from RSR’s first benchmark report on the retail payments process, released in March 2013.

Interesting data? Personally, I think it speaks volumes… transaction volumes, that is. To exponentially expand their business, all a bank or payment processor needs to do is:

- Support an ever-growing number of payment options,

- Show immediate responsiveness to consumer transaction issues, and

- Explore a few ways to keep down processing costs

How hard can that be, really? Ha.

If you work for a bank or payment processor, and spend your days within an IT operations environment, you already know the answer.

As consumer demands for more service and payment options continue to grow, retailers are expecting banks and payment processors to “keep up” and expand processing capabilities to cover all emerging payment channels. As a result, IT operations teams are finding themselves monitoring more diverse transaction types and taking responsibility for a transaction switch that needs to do a lot more than it used to. We have heard many of our own banking and payment processing customers make the analogous reference to new service roll-outs as “the straw that broke the camel’s back.”

Today, there are more third party applications and stand-alone software modules being layered over switching applications than ever before. Many use modular architectures that wire together multiple, distributed components (e.g. HSMs, preferences servers, databases, 3rd party services) to execute a single transaction. And, increasingly, IT operations teams are facing pressure to run all of this in a private cloud environment to simplify scaling and disaster recovery.

Modern switching applications are also playing host to an explosion of message-based services ranging from POS, mobile and online purchase applications, to security encryption, to the looming EMV. Many of these critical security and service applications are moving to, or already reside in SaaS, virtual or Cloud-based environments, making visibility into business activity levels and end-to-end transaction performance tough.

This is even more of a struggle for payments organizations that are failing to upgrade their application performance monitoring tool sets through this transition – leaving them with diminished visibility into application and transaction performance. In many cases it’s impossible to upgrade legacy tools to operate effectively in a modern transaction switching environment.

So rolling out new services, implementing new architectures, and managing a consolidated payments environment does have its challenges for banks and payment processors… Delivering the ideal end customer experience to retailers and the operational efficiency needed to control processing fees is definitely getting more complicated. But for the banks and payment processors that do figure out how to guarantee service delivery and operational efficiency across all emerging payment channels, the payoff will be tremendous.

To delve deeper into the business challenges, opportunities, and organizational inhibitors that ultimately shape retailers’ technology investment priorities, take a look at: Retail Payments: When the Future Becomes Now , RSR’s first benchmark report on the retail payments process. It can be downloaded for free from the link above.

If you would like to learn more about the role transaction-centric application performance management solutions such as INETCO Insight play within multi-channel retail payment environments, contact us for a demonstration.