Have you been to a conference recently where they had a session on Big Data?

Have you watched a webinar or downloaded a whitepaper about unlocking your Big Data?

Are you looking for a little less talk about why you need Big Data, and a little more information on HOW you can derive actionable intelligence from it?

Good—because in this week’s post you’ll learn how you can easily access your ATM Big Data, and how it can provide actionable intelligence to lower operational costs, generate more revenue, and improve customer experience.

Photo courtesy Columbia Pictures

If you are in retail banking it is likely that you are investing in more sophisticated, interactive ATMs to handle a greater number of transactions traditionally carried out by costly tellers (mortgage applications, account balance inquiries, check deposits…). These expanding services and the growing number of customers choosing self-service options are resulting in an explosion of (big) data available from your ATM network. The key is finding a cost effective way to access this data, a method that doesn’t require you to assemble a war room of specialists and data extraction tools before you are able to generate actionable intelligence.

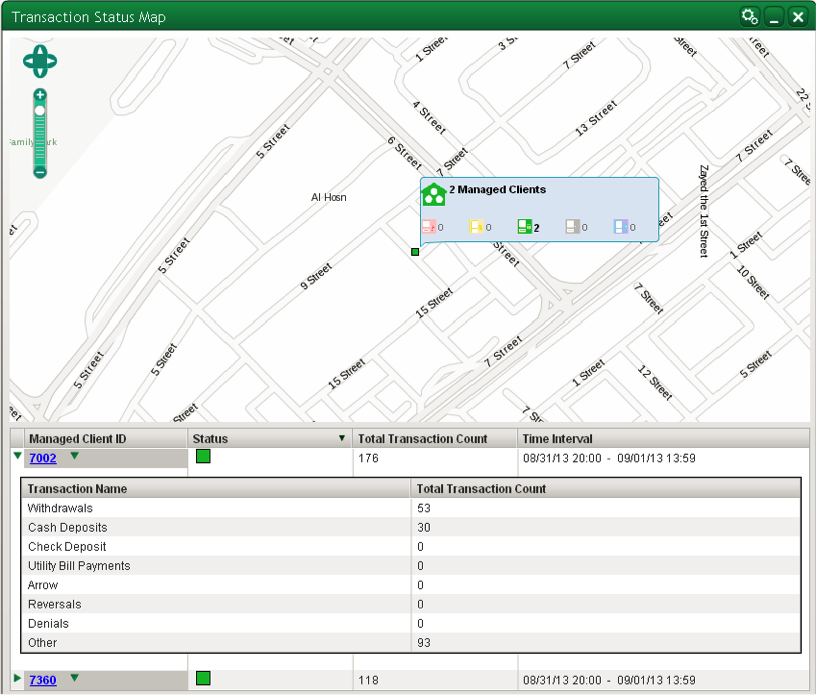

Fortunately, a real-time transaction monitoring and analytics solution can help retail banks and credit unions easily access and process ATM transactional data so they can make better and more timely decisions. This type of banking software platform captures the Big Data flowing across your ATM networks and provides a centralized deposit of rich transaction information. Its analytics engine enables you to produce customized statistics and key performance indicators—actionable operational and business intelligence that allows you to:

Better serve your ATM customer:

- Analyze uptime and availability statistics specific to ATM, switch, 3rd party service connections, and card type

- Generate automatic reports on number of incidents reported by end customers

- Understand customer usage by card type, service type and ATM terminal location

Reduce ATM support costs:

- Track payment failure rates by root cause

- Analyze approved/declined/failed transactions by card,service type or ATM terminal ID in real-time

- Quickly assess the direct business cost associated with system downtime and loss of business

Improve ATM channel profitability:

- See hourly withdrawal and deposit transaction information to pre-emptively respond to cash-low events for busy ATMs and new cash point scenarios

- Create marketing campaigns based on which competitor cards are using your ATMs, “on us” versus “off us” transaction comparisons, and the most popular value added services

- Get a breakdown of customer transactions by ATM such as withdrawals, deposits, inquiries, bill payments, transfers and other value added services; understand failed customer transactions by value of service revenue lost

Transaction monitoring and analytics solutions provide access to a wide range of customized ATM service and cash management statistics to help retail banks manage targeted campaign performance, enhance the profitability of their ATM channel, and ensure important customer interactions are secure and reliable. ATM channel managers and marketing teams will learn to love Big Data as it helps them make better business decisions regarding ATM locations, service offerings and card bases. Operations teams will be able to produce a wider array of customized alerts and performance statistics that lead to improved service availability and reduced support costs. Granular usage information such as which transactions were more common at a particular ATM, how much service revenue was produced, how many banking transactions were successful, or how many were unsuccessful provide a centralized easy way to listen to how your ATM network is performing.

For more information on how you can generate actionable intelligence and learn to love your ATM Big Data, download this whitepaper.

English

English French

French Portuguese

Portuguese Spanish

Spanish