Customer analytics is the use of a wide variety of data sources to understand how customers behave. In retail banking, understanding customer behavior can help you tailor product and service offerings to encourage loyalty, increase revenue, decrease risk, and align service costs appropriately.

Customer analytics is the use of a wide variety of data sources to understand how customers behave. In retail banking, understanding customer behavior can help you tailor product and service offerings to encourage loyalty, increase revenue, decrease risk, and align service costs appropriately.

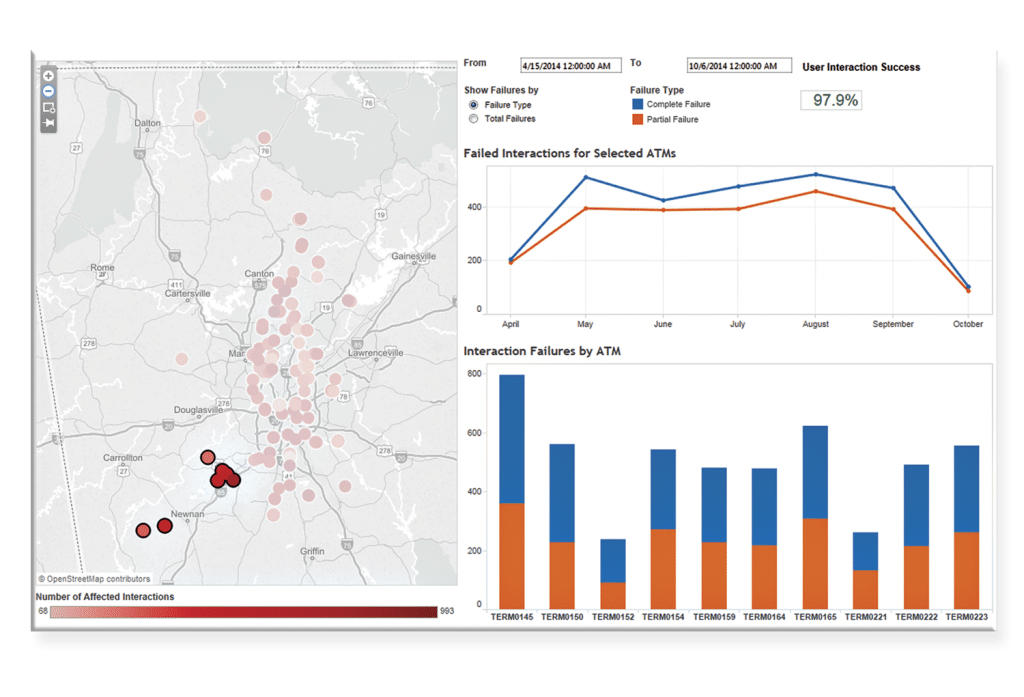

As customers interact over a broader variety of channels and use more self-service technologies, we need to look at things from the customer’s perspective, as opposed to more traditional financial-, product-, or channel-centric vantage points.

The challenge is that most banks lack the means to easily and systematically analyze customer behavior. Instead of an automated process performed by software (like financial analysis or product analysis), customer analytics is a labor-intensive, time-consuming manual process conducted by channel managers and marketing executives.

You may be wondering why, or if you’re a channel manager, maybe you aren’t! Regardless, it’s because customer interaction data is captured in bits and pieces by a variety of systems. It doesn’t end up in one place (e.g. data warehouse, your core, etc.). Instead, some interaction data is captured by your ATM software, other bits by your web analytics software, some by your core, some by 3rd party systems, especially if you’ve outsourced parts of your mobile, internet, or online banking infrastructure.

As a result, channel managers have to source out all these pieces of data, acquire them, and then integrate them somehow to gain insights. This typically involves Excel and lots of waiting.

We’ve found that the fundamental questions you need to answer are deceptively simple:

- Who did we serve?

- Where did they interact?

- What did they do?

- How long did it take?

- Were they successful?

Then you want to start segmenting – by customer type, location, demographics, time of day, etc. And sub-segmenting: on us customers, off us customers, platinum customers, etc.

So, to do customer analytics well, you need three things:

- A readily accessible and complete source of customer interaction data

- A range of complementary data like demographics, BIN lists, ATM descriptions, etc.

- A tool to explore, segment, and present customer interaction data

In our next few blogs, we’ll explore each of these areas in more detail

If you are interested in learning about INETCO’s own customer analytics software, INETCO Analytics, including insights into payment fraud analytics, watch this 2-minute introductory video.

Part 2, Part 3, and Part 4 of this series are also available!