In a webinar held earlier this week, INETCO, Fiserv and ATMmarketplace.com made reference to a new type of consumer that is challenging the banking industry. This new group is growing alarmingly fast, and has been greatly enabled by all the investments banks and other Fintech players have made in digital technologies, self-service, microservices and APIs. Who are they? They are known as the Überbanked Consumer.

In a webinar held earlier this week, INETCO, Fiserv and ATMmarketplace.com made reference to a new type of consumer that is challenging the banking industry. This new group is growing alarmingly fast, and has been greatly enabled by all the investments banks and other Fintech players have made in digital technologies, self-service, microservices and APIs. Who are they? They are known as the Überbanked Consumer.

Überbanked is a new terminology describing consumers that are “over banked”. It is linked to the phenomenon occurring within the banking industry, whereby the traditional value of a Bank (as a central trusted intermediary) is becoming eroded by the new models of technology-to-consumer exchanges.

The typical Überbanked Consumer holds multiple deposit accounts, is tech savvy, and willing to shop around for the best deal. They crave convenience, low costs, and great consumer experiences. They take advantage of new technologies and delivery channels to construct a portfolio of financial products and services sourced from multiple financial institutions, peers and alternative service delivery providers.

Many of the Überbanked consider their banking relationships to be merely transactional, resulting in less loyalty and waning dependency on any one retail bank. This means that with the rise of the Überbanked Consumer, many retail banks will need to rethink their service game. How do you increase your chances of providing relevant services to your customers, and stop them from defecting silently, taking major chunks of business with them?

The answer is a pretty simple one – by winning your customers, one transaction at a time.

The Überbanked Consumer evaluates financial service processes primarily based on how effectively they are able to execute the transactions they desire, not based on their relationship with a branch teller or financial services manager. If your customers care most about transactions, shouldn’t you, too?

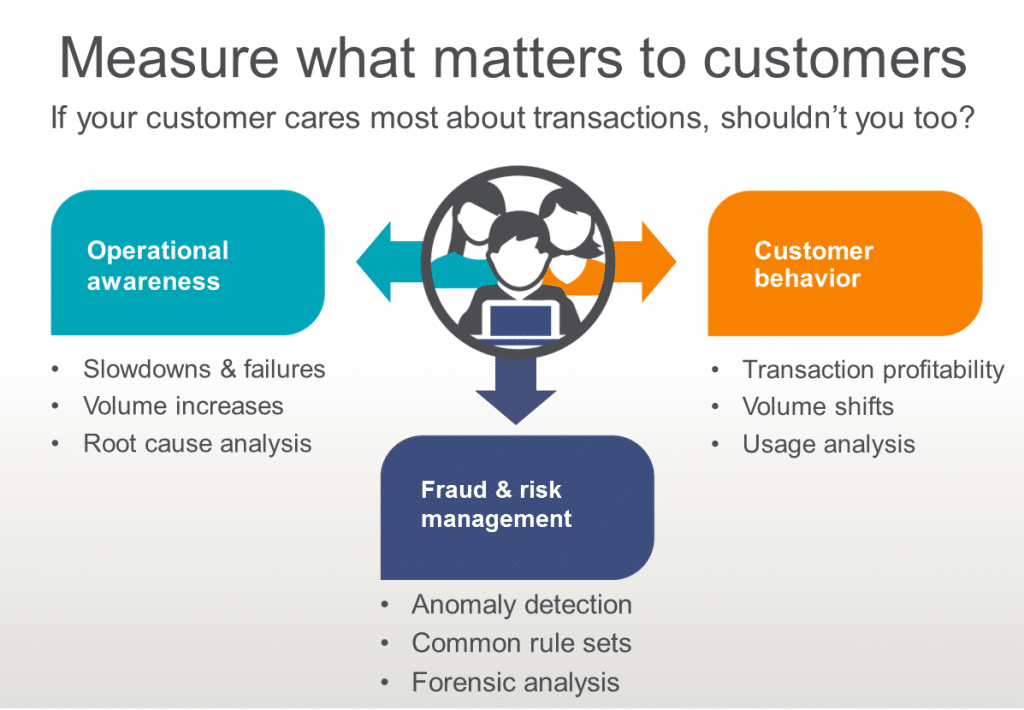

Transaction data holds a wealth of information that can impact operational performance, fraud detection and customer experience. If properly monitored and visualized, this data can provide real-time warning notifications of customer performance issues or anomalous activity across all your technologies and banking channels. It can also be used to analyze customer behavior and identify opportunities to further improve customer experience and profitability.

If you are experiencing the rise of the Überbanked Consumer within your financial organization, I would love to hear how this new profile of customer is impacting your business. If you are interested in learning more about how transaction data can be utilized by operations, business, fraud and risk management business units within your organization, you can also watch this on-demand webinar titled, “Five Awesome Ways to Improve Customer Engagement”.