Learn how INETCO helped banks, credit unions and payment service providers improve customer experience, detect fraud faster and optimize transaction performance in 2019.

1st Quarter

INETCO Responds to FBI Warnings and Hidden Cobra Attacks

Learn how to adopt early warning payment fraud strategies that detect card fraud as it is unfolding – not after the damage is done.

INETCO Releases Whitepaper on How to Prevent ATM Cash-Outs

Explore how multi-point, network-based transaction performance visibility enables you to identify missing or tampered links indicative of malware attacks.

Turkey’s BKM Achieves 88% Faster Mean-Time-to-Repair with INETCO Insight

Learn how BKM, Turkey’s national Switch provider, uses INETCO Insight to improve service level delivery through end-to-end transaction visibility.

INETCO Hosts Webinar Exploring How Banks Can Leverage ATM Big Data

Explore developing use cases that leverage real-time transaction data for analyzing customer interactions and ATM channel performance, increasing ATM operations efficiency and reducing the risk of logical attacks.

2nd Quarter

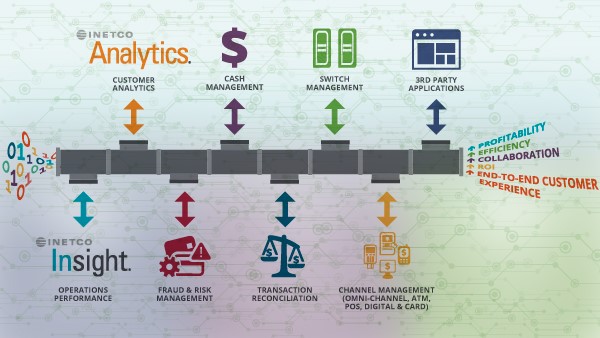

INETCO Announces New Data Access Options for INETCO Insight

Featuring a variety of data forwarding and streaming options, INETCO Insight helps you centralize transaction intelligence and deliver timely data to the teams and applications that need it most.

New INETCO Infographic Takes a Deep Dive into the State of ATM Fraud

With $400K USD withdrawn from ATMs worldwide every second, are ATMs still alive, relevant and reliable?

INETCO Releases Whitepaper on ATM Big Data Use Cases

Learn how to use real-time transaction data to support a profitable strategy around digital transformation, channel distribution and customer service delivery.

INETCO Releases Blog on How to Seamlessly Transition to ISO 20022

With ISO 20022 projected to support 79% of the volume of worldwide transactions by 2023, is your organization ready to make a seamless transition?

3rd Quarter

INETCO Announces New Real-Time Payment Fraud Detection and Prevention Platform

INETCO unveils next generation payment data acquisition, machine learning capabilities and risk scoring for real-time payment fraud detection and prevention.

INETCO Releases Whitepaper Outlining New Machine Learning and Risk Scoring Capabilities

A whitepaper to help you detect and prevent payment fraud in real-time with payment data acquisition, rules-based alerting and adaptive machine learning.

Woodforest National Bank Improves Efficiency and Customer Experience with INETCO

Learn how one of the largest community banks in the US uses INETCO solutions to improve operational efficiency and promote fact-based decision making, even down to the card program and branch level.

INETCO Releases Blog Discussing How to Defend Against Transaction Reversal Fraud

Your neighborhood ATM has always been a tempting target. Learn how to prevent fraudsters from playing on the vulnerabilities of the cash dispenser – specifically through TRF.

4th Quarter

INETCO and Moneta Customer E-Global Shares the Secret to Securing the End-to-End Customer Experience

Explore how Mexico’s largest electronic payments processor consistently secures the end-to-end customer experience while processing more than 13 million credit and debit card transactions each day.

EVERTEC Costa Rica, S.A. Improves Customer Experience Delivery, Operational Efficiency and Profitability with INETCO

EVERTEC Costa Rica, S.A. Improves Customer Experience Delivery, Operational Efficiency and Profitability with INETCO

Learn how one of the largest merchant acquirers in Latin America uses INETCO Insight to easily identify network outages, third party disconnects or application latencies that affect consumer payment transactions.

Payments Business Magazine Features INETCO On How to Combat Fraud with Centralized Data

Payments Business Magazine Features INETCO On How to Combat Fraud with Centralized Data

Learn how centralized, real-time transaction data collection and cross-functional adaptation are essential when it comes to delivering solutions at a new speed and scale, while continuously improving the CX and fraud security aspects of every payment transaction.

Interested in reading the newsletter in full? Click here. No time to read but ready to take control of increasing complexity across all your ATM, POS, online, branch and mobile banking channels? Contact .