ATM Marketplace has surveyed nearly 800 financial institutions (FIs) and banking technology leaders from around the globe to provide a comprehensive look at what’s happening in the ATM software world and the ATM’s role in serving financial institutions’ customers. Now in its seventh straight year, the ATM Software Trends and Analysis report has become a trusted tool for FIs as they plan their investment in new technology to enhance their ATM service offering.

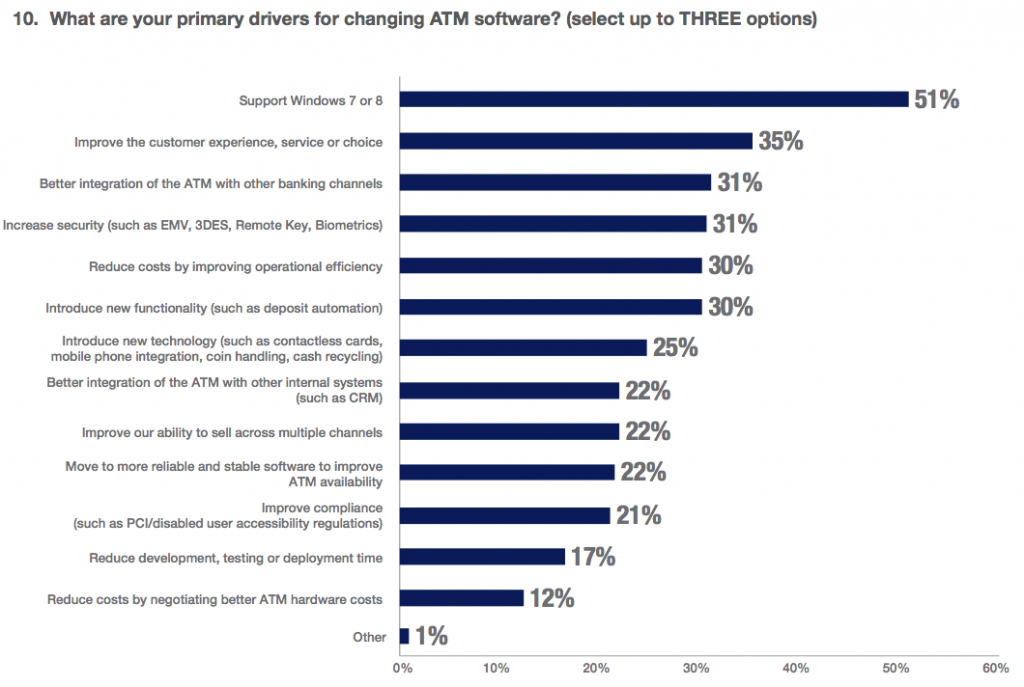

There were some notable differences from this year’s report compared to last. After “support Windows 7 or 8”, now over a third of respondents wanted to change their ATM software to improve the customer experience. Better integration of the ATM with other banking channels, and reducing costs by improving operational efficiency, followed closely behind.

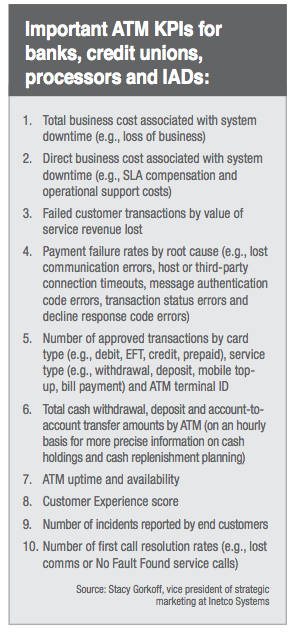

The report goes on to discuss how “[i]n today’s complex ATM network environments, most issues affecting the completion of customer interactions occur beyond the ATM and usually are related to network communication errors, third-party disconnects or application performance problems,” (p.29). As such, more banks and credit unions are recognizing the need for a complete enterprise view of the customer experience at the ATM, and of the entire ATM network’s operational performance. Mercator’s Ed O’Brien expressed how FIs are looking to Application Performance Monitoring (APM) systems to help them quickly identify and resolve ATM hardware, software, and network issues. INETCO’s own Stacy Gorkoff stated that “[r]eal-time, end-to-end network and application monitoring is a key requirement for any bank, credit union, IAD or ATM payment processor.” Stacy also listed out the top 10 ATM key performance indicators (KPIs) for banks, credit unions, payment processors and IADs (see below).

You can access the full 2014 ATM Software Trends and Analysis report at ATM Marketplace.

And if you’re in London for next week’s European ATMs and are interested in learning how you can gain full enterprise awareness across your ATM line of business, let me know and I can schedule a time for you to speak with INETCO’s Stacy Gorkoff in the NCR booth (#35).

English

English French

French Portuguese

Portuguese Spanish

Spanish