Now that the wrapping paper has been cleaned up and the confetti swept away, it’s time for INETCO’s first 2014 blog post. And what better way to open up the year than with some bold transaction performance predictions!

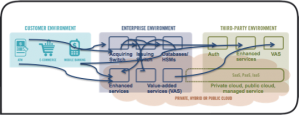

Last week INETCO was fortunate to have both ATM Marketplace and Technology Banker feature our predictions for 2014. In these articles we discuss how we foresee ever greater consumer adoption of non-traditional banking channels (mobile banking apps, online banking, remote deposit capture), how banking customers will expect to have all these channels automatically communicate with each other, and how this will greatly increase the number of and complexity within the transactions that financial institutions will need to manage.

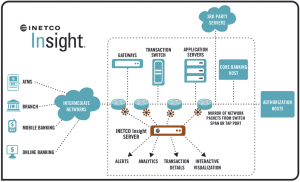

With this rapidly growing number of complex “multi-hop” transactions (ie: transactions that move from check capture at an ATM or mobile app, to switch, to third party backend, etc.), we also predict that more banks and payment processors will recognize the necessity to monitor and be alerted to transaction problems before customers’ experience is affected. To get effective visibility into every transaction, we foresee greater adoption of robust business transaction management (BTM) software like INETCO Insight.

To quote myself from ATM Marketplace:

“BTM will allow institutions to resolve transaction issues more quickly (up to 75% by our studies), as this software can pinpoint problems no matter whether they arise from within an institution’s own core banking environment (app, server, or backend) or that of a third party service provider. As millions of customers start taking advantage of new banking services, [financial institutions] will take on greater transaction complexity. And they will look to new monitoring and analytics technology to help them gain the operational efficiency and reliability they need.”

Have your own prediction for 2014? Leave us a comment below.