Recently I had the fun opportunity to host a webinar with Celent’s Daniel Latimore, where we explored the relevance of real-time data in retail banking. Despite some computer glitches and a lot of hand waving in the background, I think it went pretty well…but of course I am biased, and would love to hear your opinion, so here’s the link: https://www.brighttalk.com/webcast/12027/247779

For those of you with shorter attention spans, and willing to admit that your chances of watching this one-hour presentation are pretty slim (you are my people), let me share the top three findings presented.

1) Real-time isn’t needed for everything.

There are still many scenarios where a bit of data latency may not make such a huge difference, and using traditional business intelligence tools or relational databases to get updates once an hour or every ten minutes is quite enough. That being said, there are plenty of banks already making the conscious business decision to make the move beyond “managing data” to “acting on continuous data streams”.

2) There are a growing number of use cases where real-time data does make sense.

There are a growing number of use cases where a “slow motion” approach to data acquisition and processing is not enough. Some of the common characteristics driving real-time use cases include:

- Growing customer expectancies – Customers want instant gratification, and in many cases banking interactions are contextual and must happen immediately. Timing is everything.

- Shrinking decision windows – More time sensitive use cases where a delayed reaction could hurt customer loyalty, channel profitability or the reputation of a bank.

- Increasing data velocity – Quickly spotting risks and opportunities in data related to card payment transactions, IoT objects, mobile, sensors or clickstream data. The analysis of these data sets needs to be done fast to avoid this data becoming a wasting asset.

There are also new real-time use cases emerging as a byproduct of continued investment in new technology infrastructure – Decreases in hardware costs, and technology advancements in areas such as live data streaming, scalable data storage, faster processing and real-time analytics have made it way easier for FI’s to adopt real-time systems. Coupled with cognitive machine learning and predictive algorithms, you can now perform continuous analysis on data points that can be used to change decisions, and determine a new business path at any time.

3) Current business cases for real-time data are primarily linked (but not limited to) to risk mitigation.

This includes the ability to recognize fraudulent activity, reduce operational risk and identify smaller front-line Advanced Persistent Threat (APT) attacks earlier. Revenue uplift through increased customer satisfaction and timely personal offers was also discovered to be a real-time value lever, along with cost-to-serve reductions obtained through predictive maintenance, reduced back office activity and avoided mismatches between systems of record and engagement.

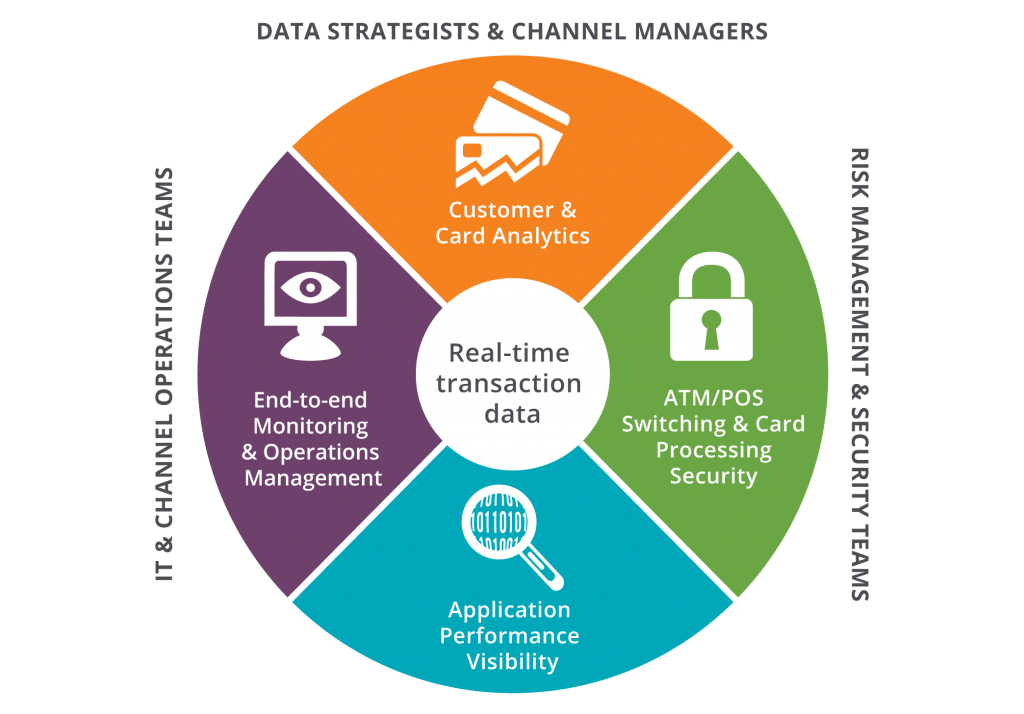

At INETCO, we like to help financial institutions and payments processors match the dynamic nature of their customers. We do this by making real-time customer transaction data easily accessible for performance monitoring, usage analysis and anomaly detection. With the power to access continuous transaction data streams, our customers gain a whole new level of agility when it comes to decision making.

Following the trend of emerging real-time data use cases, we have found that our own repertoire of real-time, transaction-oriented use cases continues to grow, as well. Some examples include:

- IT operations and channel systems operations teams that are moving towards predictive maintenance and efficient management of operations environments

- Risk and security management teams looking to quickly spot transaction anomalies, card processing issues and terminal vulnerabilities

- Channel managers and digital data strategists that are interested in improving customer responsiveness and continuously monitoring card program adoption, usage and defection

And that is what we talked about, in a large nutshell. With that, I’ll leave it to you to either watch the full webinar, or if you would like some help wrapping your head around a business use case for real-time data, request a demo with our helpful team.

English

English French

French Portuguese

Portuguese Spanish

Spanish