INETCO thrives on helping financial institutions deliver an amazing customer experience through optimized transaction performance, faster detection of transaction-level fraud and maximized business value from payment intelligence. Our core competency lies in our ability to decode a wide variety of payment protocols on-the-fly, making comprehensive transaction data ready for real-time analysis. FIs can continuously feed this data to rules-based alerts, configurable risk scoring and machine learning algorithms, analytics dashboards and now…drumroll please…the INETCO Insight case management and workflows engine.

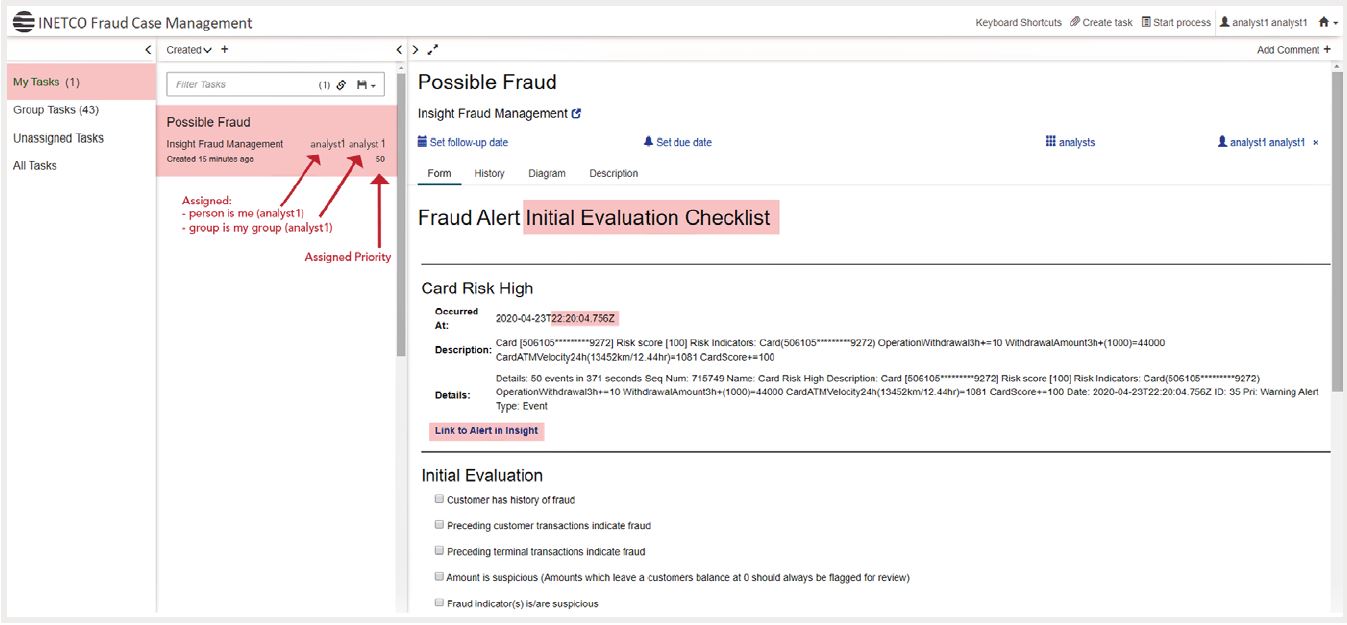

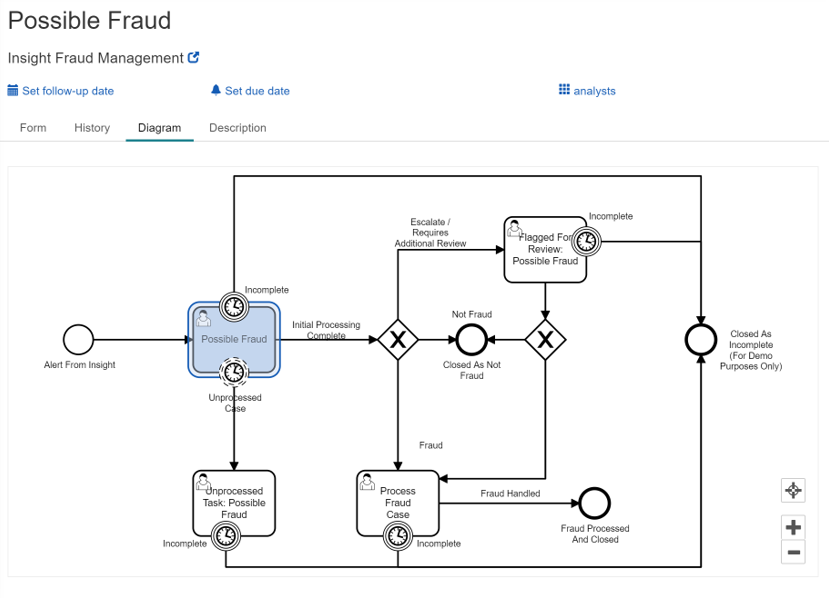

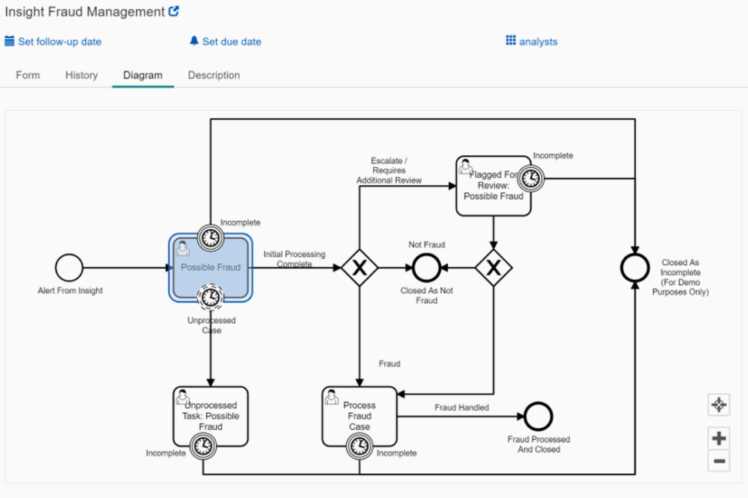

INETCO Insight features case management and workflows that help our customers promote real-time collaboration, establish a simplified triage system and speed up the investigation (and blocking) of suspicious transactions.

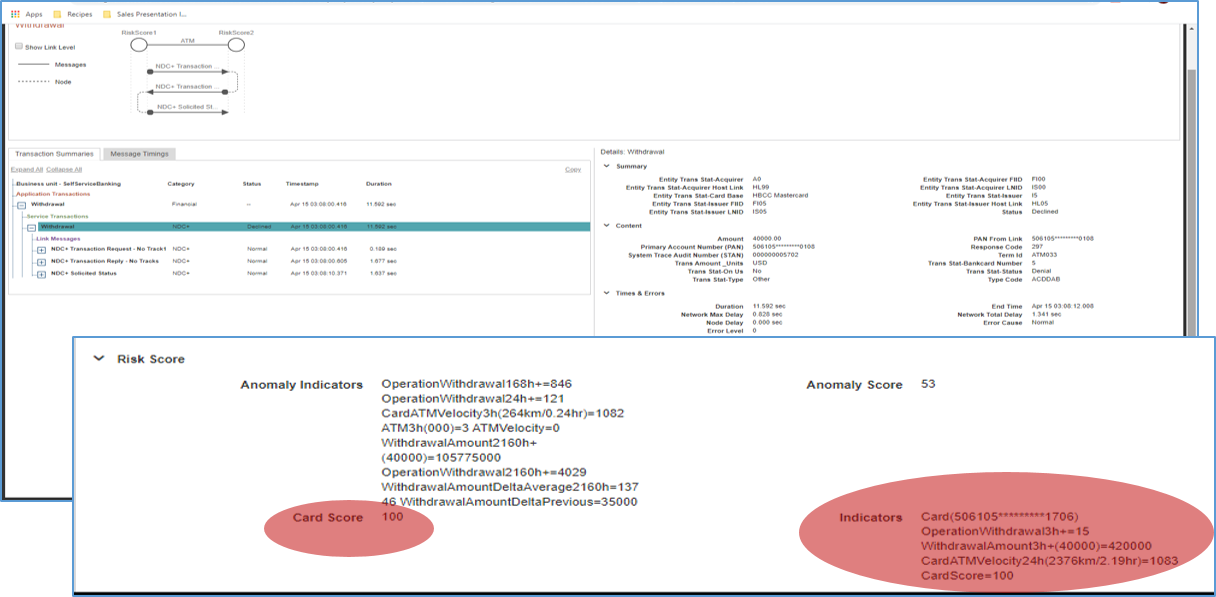

Seamlessly combined with the real-time data collection, rules-based alerting, risk scoring and machine learning capabilities also contained within INETCO Insight, this module provides a systematic and repeatable process for tracking, evaluating and prioritizing flagged transactions. Logical workflow rules help streamline fraud investigations, with risk scores, alert specifics and suspicious transaction details linked directly to each task.

With real-time payment data acquisition and the right combination of rules-based alerts, configurable machine learning, case management and workflow capabilities, FIs can implement more precise risk scoring, transaction blocking and investigation tactics to speed up investigation and reduce the amount of false positives associated with traditional payment fraud detection. For more information on how INETCO professional services can get you started with our case management customization package, contact insight@inetco.com.

English

English French

French Portuguese

Portuguese Spanish

Spanish