More digital channels and payment gateways. New customer demands. A 10-15% increase in transaction volumes per year.

For some card payments processors, this equates to a hellish perfect storm. For others that are investing in real-time data visualization, this is an exciting opportunity to deliver the ultimate customer experience.

“A big part of becoming truly customer-centric, and successfully launching new payment applications is providing a customer interaction experience that feels “easy” and effortless, with continuity across all digital channels. This is where gaining real-time visibility into every customer transaction becomes crucial. With INETCO Insight, we can move towards a centralized transaction hub to really understand a customer’s experience across all channels.” DR. SONER CANKO, GENERAL MANAGER OF BKM

Bankalararası Kart Merkezi – Interbank Card Center (BKM) is the centralized card payments processor for all of the issuing and acquiring institutions in Turkey. They are strongly committed to providing the best service level delivery possible to its domestic institution members, the retail industry and their cardholders. Card payment systems and services for their 33 Members include:

- Validating interbank transactions and performing clearing for close to 10 million transactions per day, routing through a number of different payment gateways

- Performing strategic operations throughout the country for card payment systems

- Developing the rules and standards for domestic credit, debit and prepaid cards

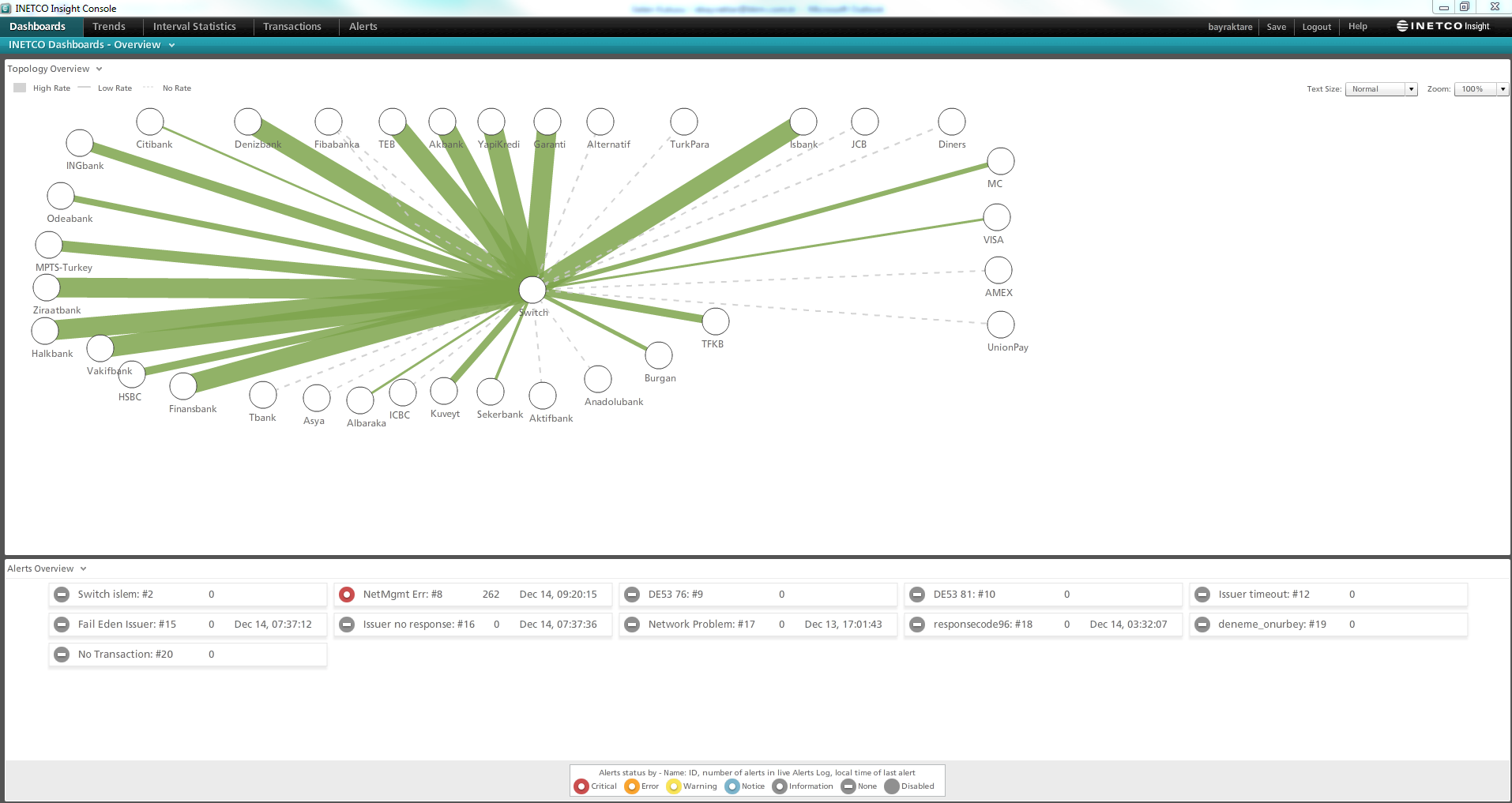

Knowing that undetected transaction failures and slowdowns have a negative impact on both BKM’s service level delivery as well as their member institutions’ end customers, BKM turned their focus on establishing end-to-end visibility into the lifecycle of every transaction. While they could partially monitor internal Switch application messages from database log tables, it was challenging to easily analyze these in relation to the external formats of transaction messages. This meant that if a transaction issue occurred either before it made it to the Switch or after it left the Switch, it was difficult to detect and isolate the root cause of these issues in a timely, cost effective manner.

INETCO Insight gave BKM the ability to correlate the incoming transaction response messages and outgoing messages together — to automatically create individual transaction profiles out of the Switch system that contained all the data field elements needed to quickly isolate where a performance issue was taking place. This was done for both domestic ISO8583 messages and standard message types (including Visa VIP, MasterCard Banknet, UnionPay, Discover, JCB and Amex), while still applying masking logic that meets stringent PCI DSS security regulations.

With INETCO’s real-time transaction monitoring and data streaming platform, BKM was able to investigate issues, transaction by transaction. They can now securely monitor all transaction message details, TCP connects/disconnects, and the data element conversions between different formats and message flows – in one centralized view. They are no longer dependent on their Members to send samples of transaction messages. Average mean-time-to-repair has gone from hours and days to minutes, enabling BKM to focus more energy on:

- Delivering more relevant omni-channel customer experiences

- Pushing the digital transformation agenda for the end-to-end enterprise architecture

- Efficiently managing the performance of both new and legacy payment applications

To learn more about how BKM benefitted from utilizing INETCO Insight to monitor their active-active, load balancing infrastructure, read the full case study here.

English

English French

French Portuguese

Portuguese Spanish

Spanish