For many banks, payment processors and card network providers, the main purpose of an active/active architecture is to achieve load balancing, improve throughput and guarantee response times. For one global card network provider that processes transactions for high net-worth clients across 14 countries in the Middle East and North Africa, adopting this type of infrastructure within their Postilion payments switch environment was crucial to handling their growing transaction volumes without lag or downtime.

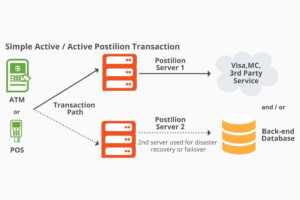

Postilion provides banking transaction switching software that routes financial transactions. Most of the time Postilion switch software servers are set up in a relatively simple fashion, whereby transactions flow into the switch, which then sends them through to their appropriate destination (per the image below).

Postilion switches can also be deployed in an active/active environment to ensure higher ATM and POS network availability. In this case, transactions will keep flowing through one Postilion switch unless transaction volumes exceed a set threshold or there’s some sort of problem with that particular path, at which point a secondary route exists. This type of architecture is most often used as part of a disaster recovery (DR) or service level agreement (SLA) plan.

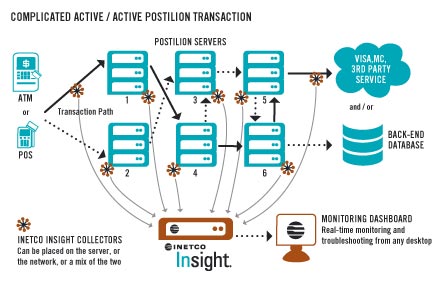

Within a Postilion active/active environment, monitoring a transaction can be quite daunting. If you tried to watch each Postilion server, you’d have to keep your head on a swivel so that you could catch what was happening on each reporting screen. Pinpointing exactly what type of transaction might be causing issues, and before major slowdowns and failures occur, can be near impossible. This is why the deployment of a transaction-level monitoring solution that can effectively monitor complex payments ecosystem – in real-time – is almost as important as the Postilion active-active architecture itself.

Now going back to the case of the global card network provider we referred to earlier in this blog…

This provider needed a real-time solution that could monitor a complex payments network comprised not only of a Postilion active/active architecture with multiple servers and data centers, but also the interconnectivity of their payment switch, card management system, internal network, telecom provider, and the 54 third party (ATM, POS, back-end) service providers they relied upon. Because the end customer experience was (and still is) paramount, even a one-second improvement in transaction speed would translate into significant returns.

Enter INETCO Insight…

With INETCO Insight, you can monitor every transaction as it flows through your payments ecosystem and be alerted to any transaction issues, network slowdowns or problems with any of your multiple servers before getting an angry call from a merchant or an irate high net-worth customer experiencing failed or declined transactions. You are able to capture data from every link of an end-to-end transaction, and have both the application payload and network communications details (ie: request/response timings, transaction dollar values, network address information) easily accessible within one or two clicks. With a holistic view of the entire payments ecosystem, you can spot customer transaction bottlenecks before they become failures. INETCO Insight also provides the transaction level detail required to isolate whether transaction slowdowns or failures are due to the internal network, applications, or other third party service providers, speeding up average mean-time-to-repair by 65-85%.

Back to our global card network provider story…

Within the first six weeks of deploying INECTO Insight, the global card network provider was able to find the source of transaction bottlenecks that were previously known, but could not be located with legacy monitoring and tracing tools. They were able to achieve full ROI on INETCO Insight within four months by:

- Instantly gaining one-stop, real-time visibility across their Postilion active/active payments environment that included multiple data centers, a third party telecom and 54 other ATM, POS and back-end service providers

- Reducing transaction time-outs by 75%

- Experiencing network availability gains from 99.92% to 99.96%, allowing them to “recover” 50% of previously lost customer transactions and the high spend revenues associated with them

- Cutting transaction authorization times by 33% (from 6 seconds to 4 seconds)

- Decreasing the average mean time to repair (MTTR) by 65% through streamlined troubleshooting and the ability to discover transaction issues without having to analyze complex and overwhelming data logs

Read the case study to learn more about how INETCO Insight can help you monitor your complex Postilion active/active payments architecture, or simply contact us for a demo.