With Latin America facing an unprecedented increase in claims for unrecognized credit and debit card transactions, banks and card issuers are directly feeling the impact of fraud and cyber-attacks that are growing more sophisticated by the day. Recent regulations have been implemented across Latin America to address a variety of payment fraud, including an unprecedented surge in claims of unrecognized transactions involving debit, credit and financing products. This wave of enhanced regulation is just the beginning, and banks and card issuers across the region must be prepared to assume greater responsibility, meet compliance and respond to the growing threat of fraud—or risk financial and reputational damage.

In the face of this change is a critical need for real-time fraud detection and prevention solutions that provide essential visibility across all payment types and channels. Here’s why banks and payment service providers around the world are choosing INETCO BullzAI as an integral part of their compliance strategies.

Preparing to combat the evolving threat of AI-enhanced fraud

As AI-powered payment fraud grows more sophisticated, banks and card issuers must reach new levels of data precision and decision-making speed to effectively detect and prevent fraud—without impacting the customer experience.

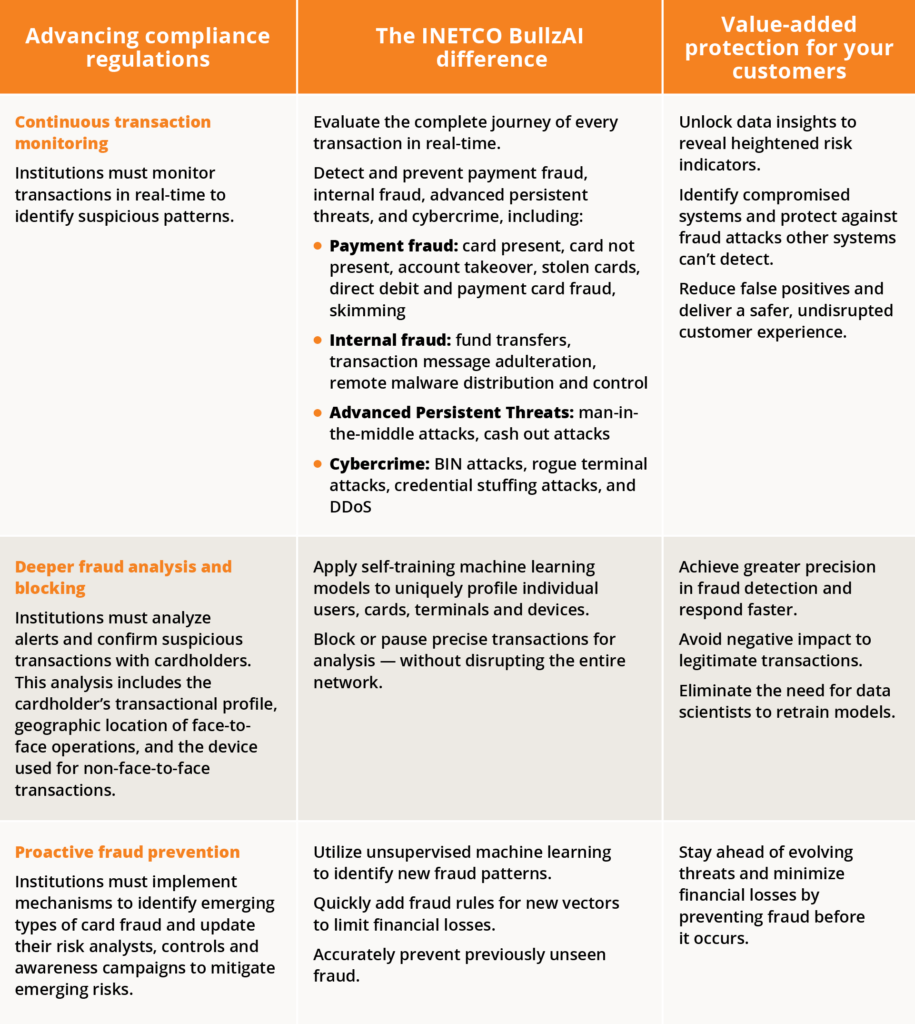

The latest changes from regulators across Latin America emphasize three critical areas:

- Faster fraud detection: Continuous monitoring of cardholder transactions to detect unusual or suspicious patterns that could indicate fraud.

- Deeper fraud analysis and blocking: Institutions must analyze alerts, seek confirmation from cardholders, and block cards when transactions cannot be verified. This includes examining transaction profiles, geographic location of face-to-face operations, and the devices used for non-face-to-face transactions.

- Proactive fraud prevention: Institutions must implement systems to identify emerging types of fraud, update risk analysis and controls, and launch awareness campaigns to prevent fraud.

Real-time fraud detection is no longer optional

The reality for leading banks and card issuers is that near real-time detection and prevention is no longer sufficient. To effectively protect customers, fight fraudsters and stay compliant, institutions must embrace true real-time detection, prevention, and precision blocking capabilities.

Trusted by financial institutions and payment service providers globally, the INETCO BullzAI solution delivers unmatched visibility into all payment types across all channels. End-to-end analysis of every payment transaction happens in real-time, helping financial institutions enhance security, build trust, and confidently deliver an undisrupted customer experience.

Unlocking next-level payments security

Adopting a new standard of precision in threat detection and prevention means your institution can provide the payment security your customers demand—every moment, every day.

Here’s how INETCO BullzAI can help you achieve these goals:

Outsmarting fraudsters one transaction at a time

As the regulatory landscape shifts across Latin America, now is the time for banks and card issuers to enhance their fraud protection capabilities. With INETCO BullzAI, you can take a proactive stance in eliminating payment fraud, maintaining regulatory compliance, and keeping your customers safe.

Ready to lead the charge in payment security and customer protection?

To learn more about INETCO and how our solutions help you stay ahead of fraud and meet new regulatory demands, download our brochure or contact us today.

English

English French

French Portuguese

Portuguese Spanish

Spanish