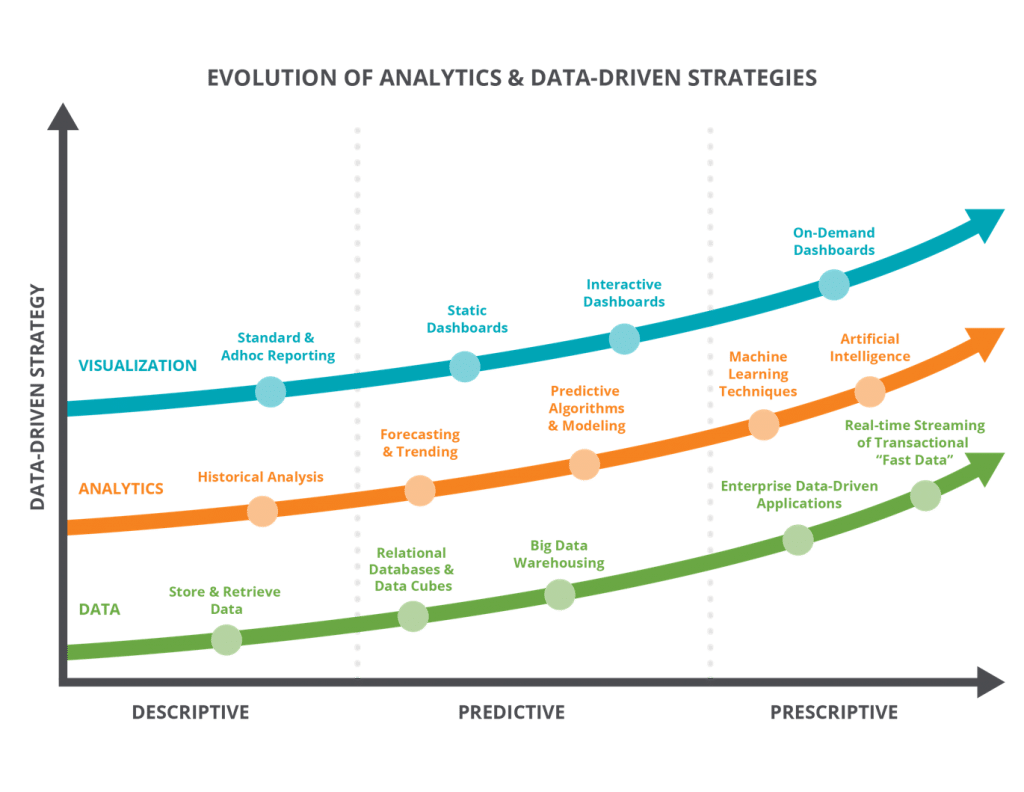

Customer analytics is not new to the banking industry. But like so many buzzwords, this term has become a catch-all phrase that causes a fair amount of confusion. Especially when it comes to investing in technology that will lead to exceptional customer experiences and better business decisions.

So what makes INETCO Analytics different than other customer analytics solutions on the market today? Simply put, our core strength is in our ability to make customer analytics easy for everyone. Here are some key product features that make this possible.

Real-time transaction data streaming

If you are familiar with INETCO, you know that we do a really good job of capturing transaction-level data – assembling detailed profiles for every transaction, across all banking and payments channels.

Traditionally, this data has played an integral role with IT teams responsible for managing enterprise-wide system performance and maximizing the completion of customer interactions. But the number and types of use cases are growing, and most relate to improving customer experience. These include: Fraud Prevention, Cash Management, Alternative Payments and Loan Applications Monitoring, Customer Experience Monitoring, Payment Card Analysis, Channel Profitability Analysis and New Customer Acquisition.

Highly scalable, cost effective data storage and management

All of us care about optimal performance and accessibility when it comes to querying, aggregating and structuring the massive data volumes inherent with customer analytics. Rather than being dependent on expensive data warehouse appliances, or being limited to sampling or collecting data over a shorter time frame, INETCO Analytics enables you to manage one integrated, master data set within a Cloudera Hadoop data cluster. This solution architecture provides the scalability, flexibility, speed and fault tolerance you need while significantly reducing the cost of data storage.

Leading edge, self-serve data visualization tools

Many of today’s banks fail to use much of their customer transaction data being collected. Sometimes this is due to reliance on a third party for hosting this data and providing canned reporting. Other times, you are dependent on a whole team of extremely intelligent analysts and operations folks to organize data and pull out what may be important. Creating a model where you are reliant on these teams to host data or supply the intelligence you need to effectively run your business definitely has its shortfalls when it comes to flexibility and timeliness.

INETCO Analytics customers have reported an average 75-80% time reduction in reporting cycles by overcoming data latency, preparation and accessibility issues. With the on-demand data visualization tools available within INETCO Analytics, you make data directly accessible for all your analytics “novices”. Transaction-level data and other relevant data sources can be streamed into custom dashboards, making it easy for all business units to visualize, query and report on relevant information, whenever they need it.

If you are interested in making customer analytics easy for everyone in your financial organization, request a demo today. Discover how advances in real-time transaction data streaming, data storage, and self-serve data visualization tools can help your organization drive exceptional customer experiences and better business decisions across all business units.