With COVID-19 continuing to affect consumers and business of all sizes across every industry around the world, there has never been a more important time for financial institutions (FIs) to ensure that payment transactions complete as expected. In the next three weeks, we will release a blog a week discussing the top tips INETCO is recommending to customers in an effort to navigate the impact of COVID-19 on their payments business.

As physical distancing guidelines remain a top priority for countries around the world, FIs are experiencing a surge in online and mobile payment transactions. With the influx of digital banking usage, performance issues and outages are also on the rise. For example, while millions check balances for stimulus checks, many top US Banks, including BB&T, Fifth Third Bank, US Bank, PNC, TD Bank and Bank of America, have reported online and mobile issues affecting customer transaction completion.

To guarantee the stability of customer transactions, FIs must be ready to manage the increased levels of online and mobile transactions. Key recommendations from INETCO include:

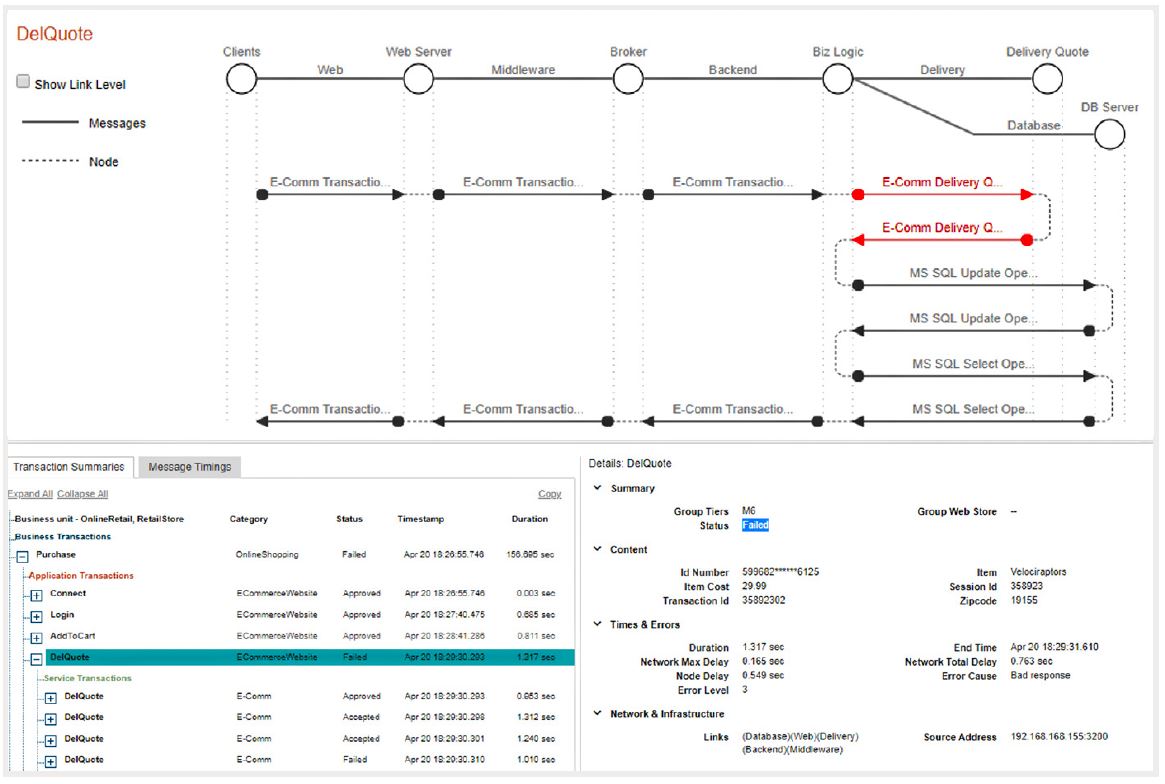

- Establish an end-to-end view into every digital payment transaction

- Continuously monitor service performance, proactively react to transaction bottlenecks before they become failures and highlight when applications are under-utilized.

- Customize rules-based alerts that reflect your known baselines and thresholds

- Receive instant notifications of transaction slowdowns, failures, anomalies, application or device volume surges and lack of activity.

- Analyze response and request times of every transaction link

- Collect information from multiple points on the transaction path and correlate this information to isolate the root cause of issues 75-85% faster.

- Monitor the performance of new mobile wallet services and application roll-outs

- Gain visibility into how transactions originating from new services and applications are performing, and ensure there is no disruption in customer interactions during roll-out.

- Ensure network communications, authorization connections and 3rd party applications run reliably

- Be on the lookout for communication breakdowns between network hops, the authorization host or third party applications, so that every transaction completes as expected.

Read more: 5 Common Types of Mobile Fraud in 2022

Download our whitepaper, Tips to Help Financial Institutions navigate the Impact of COVID-19 on Their Payments Business, now.

English

English French

French Portuguese

Portuguese Spanish

Spanish