The holidays can be a stressful time, especially for those processing POS and digital payments transactions. As discussed in last week’s blog, “The Rise of the Überbanked Consumer”, transaction experience matters to customers – a lot. The last thing a retailer needs during the peak holiday season is hordes of annoyed customers unable to complete their shopping due to a POS network issue.

To better prepare for this increase in consumer interactions, retailers, payment processors and card issuers may want to consider transaction-level visibility. Transaction data not only provides instant notification of when consumer interactions are on the fritz, but this data can also help you identify opportunities to better serve customers and increase wallet share. Let’s take a look at how visibility into transaction-level data can help with POS monitoring, planning and analysis:

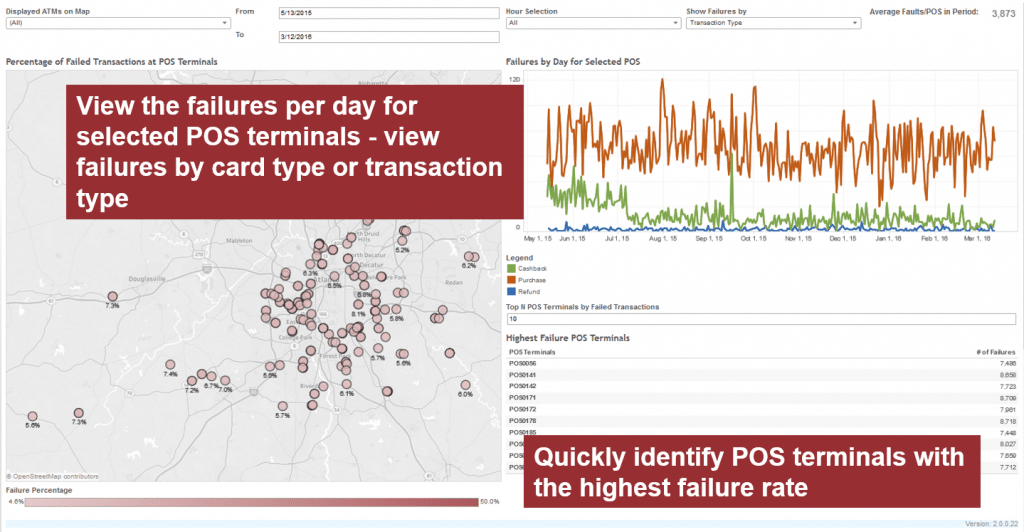

Leading up to the peak holiday season, it may be helpful to proactively identify your POS “hot spots”. These could be identified based on when POS transaction volumes and revenues will be the highest, where failures or fraud are most likely to occur, and what customer segments will be interacting with which device locations. Dashboards built using streaming transaction data can quickly tell you which POS terminals have the highest customer usage, revenue generation and risk of failure rates or fraud. This makes it easier to proactively consider success factors such as:

- Where will we need additional terminals during peak holiday season?

- On what devices are POS transactions at a higher risk of failing or slowing down? Where are EMV fallbacks occurring?

- Which of our top store locations require continuous monitoring and alerting?

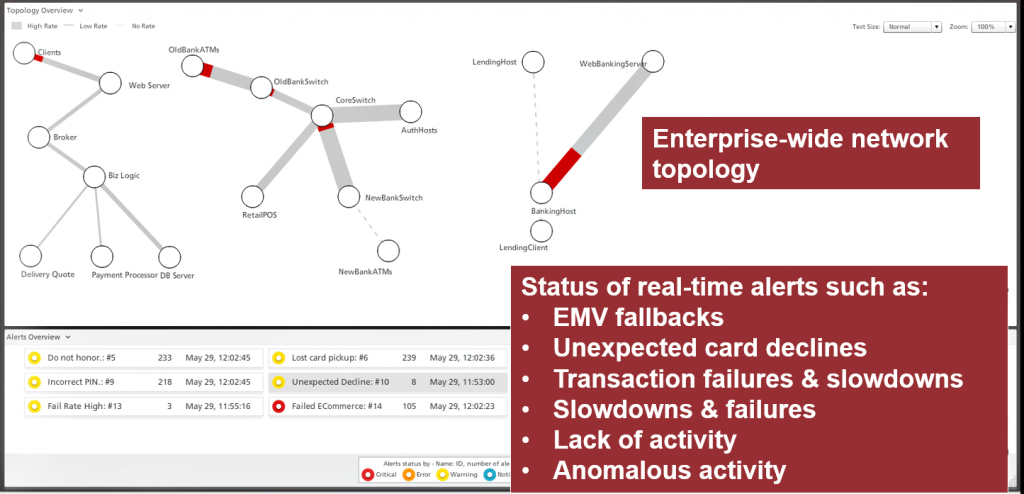

- Are transaction failures and bottlenecks occurring due to the payments switch being overloaded?

- Who do we need to talk to about being more vigilant in their service delivery? POS device providers? Payment processors? Authorization hosts? Card issuers?

During the peak holiday season, retailers, card issuers and payment processors will also need to consider quick fix strategies and damage control tactics. You need to immediately know when the customer experience is tanking, and have the ability to quickly isolate the underlying network or application issue – anywhere along the transaction delivery chain. With on-demand access to transaction-level data, an IT operations team can handle whatever the holiday shopping spree throws at them. They can trace the root cause of issues back to devices, card issuers, third party hosts, payment processors or the internal network infrastructure – on average 65-75% faster.

Once the holiday season is over, and you can breathe again, post-holiday analysis of transaction-level data can help you understand how your customers interacted with you, which POS locations were frequented the most, and how much revenue was lost due to outages, gray outs, EMV fallbacks or transaction completion issues. This valuable information can be used to make the 2017 holiday season even more successful for you!

If you would like to explore how control over your POS transaction data can save you time and money this holiday season, email us and we can explore some sweet solutions.

English

English French

French Portuguese

Portuguese Spanish

Spanish