The ability to detect logical attacks such as ATM cash-outs as they are unfolding – not after the damage is done – continues to be a priority for IT operations and security teams concerned with payments security. But there remains “no silver bullet” that provides financial institutions blanket protection from fraud. In fact, according to the 2018 True Cost of Fraud study published by LexisNexis Risk Solutions,

“…Every dollar of fraud now costs banks and credit unions roughly $2.92 in associated costs, a 9.3% increase over 2017.”

Traditional fraud system management tools that make use of contextual information to analyze transactions will provide one layer of defense against cash-out attacks. But common single point monitoring solutions still run a risk of being compromised. And they tend to be on the expensive side, to say the least.

So what about considering the benefits of a real-time transaction data platform? This solution has proven to be a reliable, cost effective way to pick up transaction anomalies, message field tampering and routing issues – especially for small to medium sized banks and credit unions that often have less sophisticated cyber security controls and budgets – but face more third party vendor liabilities.

Real-time transaction data platforms tend to yield a greater ROI that expands out of the fraud zone. This is mainly because easy accessibility to real-time transaction data really packs a punch when it comes to a number of use cases related to IT operations performance monitoring, omni-channel customer experience, card analytics, and of course, fraud. More on this in the next blog I write…

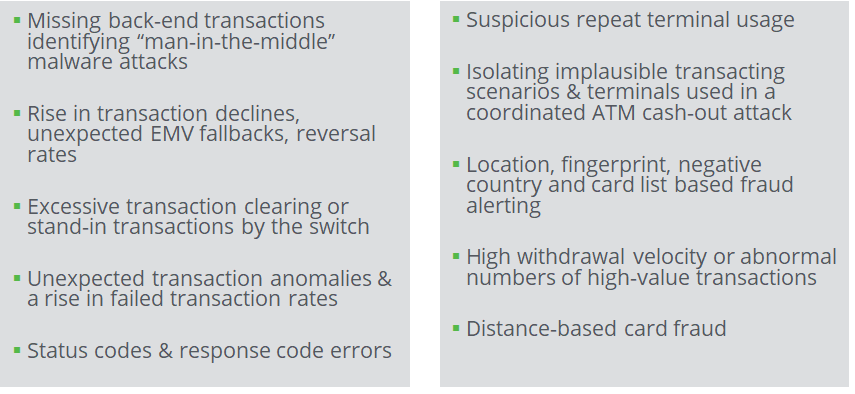

When it comes to your fraud prevention strategy, having a way to independently analyze every transaction protects you from rogue switches approving fraudulent transactions. Multi-point, network-based data collection and end-to-end correlation capabilities give you the power to immediately identify potential fraud attacks – even if these transactions bypass fraud management systems or if the fraud management system has been over-ridden by malware. Risk scores can be assigned to each individual transaction. Flexible real-time alerts flag high-risk transactions and anomalies such as:

If you are interested in learning more about real-time data platforms, and how technologies such as INETCO Insight can help you build a multi-layered defense strategy, here’s a great whitepaper for you to download: “Why a Mult-Layered Technology Approach is the Best Choice for Preventing ATM Cash-outs and Cybersecurity Attacks”.

Happy reading!

English

English French

French Portuguese

Portuguese Spanish

Spanish