Lately, I have been having a lot of discussions with various banking and payments industry folks around what INETCO wants to be when we grow up. Well the truth is, and I feel a bit like Mary Poppins when I say this, we are going where the wind takes us. And the last gust of wind has landed us in the Cloud, with an “all-in” ATM Big Data solution.

You see, INETCO’s core strengths lie in our agile nature and “yes we can” attitude. Our global customer base of financial institutions, payment service providers, IADs and retailers like us because we are always willing to get creative and explore new ways to derive meaningful insights from their goldmines of real-time transaction data. This data is often gathered across all retail banking channels or card payment ecosystems, but for the rest of this blog, we’ll focus on ATMs.

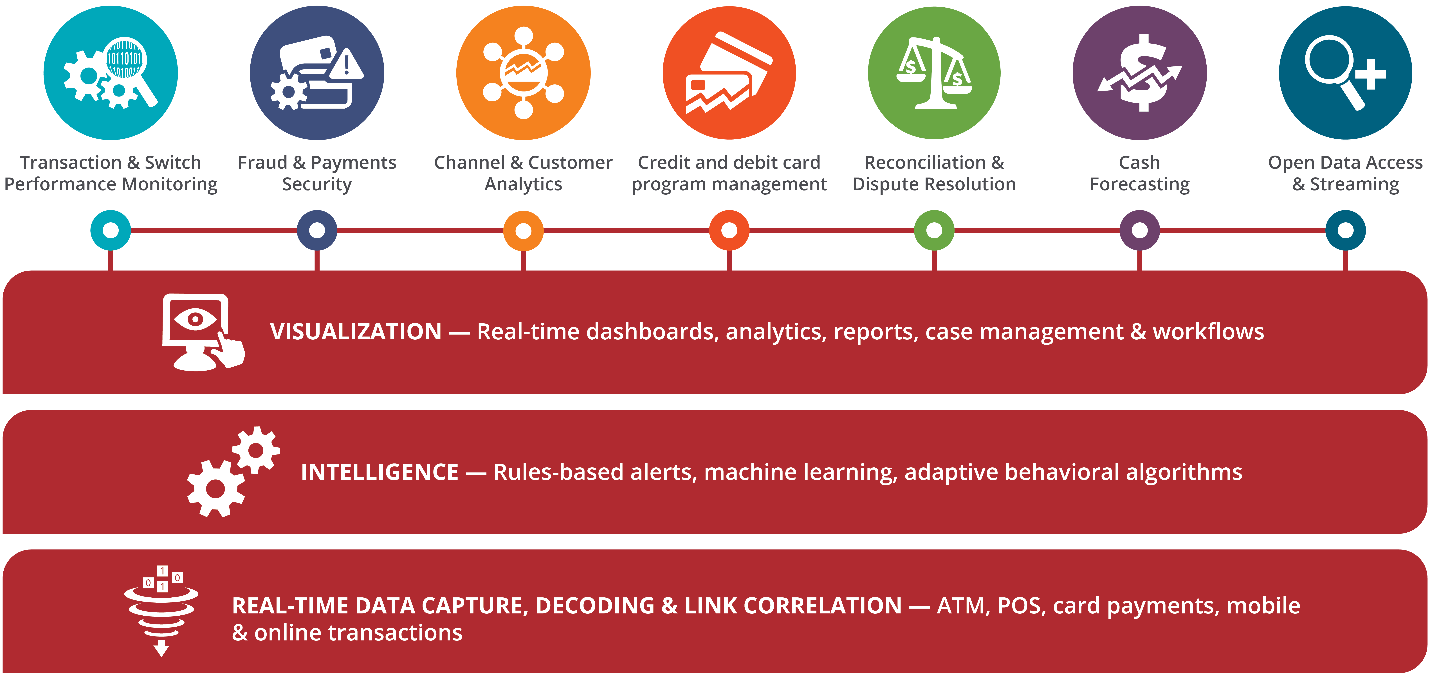

With many of our customers challenged to clearly understand how operational and customer- related decisions impact their ATM channel profitability, it just made business sense for us to develop an “all-in” ATM Big Data solution. We are talking about a real-time transaction data platform that can be either hosted in the Cloud or live on-premise, and that makes real-time transaction data workable for a number of emerging use cases related to:

- Early warning fraud detection and compliance

- Real-time payments monitoring and performance alerting

- Customer usage, ATM placement and self-service channel profitability analysis

- Cash forecasting

- Reconciliation and ATM dispute resolution

And the best part about this? Although a real-time transaction data platform that can do all that sounds expensive and complicated, it really isn’t.

So back to the question of what does INETCO want to be when we grow up. Will you find us in an uber-defined Gartner magic quadrant? No. We just don’t fit any of the molds or models of what a traditional company is supposed to do, so stop looking for us there.

But we are committed to remaining the top real-time transaction data specialists in the world, passionate about working openly with our customers, and creating “all-in” solutions for the ATM, POS, Cards and other Digital Banking channels. We remain committed to charging the new frontier for real-time data use cases, sharing what we learn with the payments community and remaining competitively priced so that no one, and no awesome idea, is ever excluded. And that is the philosophy behind our “all-in” product positioning. Practically perfect – in every way.

If you are interested in exploring what an “all-in” ATM Big Data solution is all about, you can download our whitepaper here.

Alternatively, if you want to skip the read and just talk about where real-time data use cases are going, email me – I’d love to hear from you.

Happy reading!

Stacy

English

English French

French Portuguese

Portuguese Spanish

Spanish