When I first thought about the word “Transparency” for this blog, it conjured up many images in my head. The first was one of an emperor, parading naked in his new clothes. Another was Wonder Woman’s invisible jet. But transparency means more than just seeing through things. According to Wikipedia, transparency can also be behavior related, meaning “operating in such a way that it is easy for others to see what actions are performed”.

So how does transparency behavior relate to Remote Deposit Capture (RDC)? Let me try explain…

So how does transparency behavior relate to Remote Deposit Capture (RDC)? Let me try explain…

If you were to look closely at any individual Remote Deposit Capture (RDC) user session, conducted via smartphone, online banking application, merchant capture, branch or remote deposit ATM, you would find that it was actually made up of several transactions. Usability data seen by the consumer often includes confirmation of both failed and successful check image capture transactions, pending approval messages, updated account postings, transfers and account balances. Once check images are captured, banking operations and support teams are also dealing with a number of complex, “behind the scenes” business process transactions that include real-time risk review, internal routing and posting to core processing servers, proper availability assignment and deposit transmission, and the delivery and reconciliation of check imaging transactions that require third party Federal Automated Clearing House (ACH) authorization to clear. Definitely more transactions than meet the eye…

For each of these transactions, there are multiple things that can go wrong. If a transaction such as a check image file gets lost, bottle-necked, or not transmitted properly to the ACH, banking operations and support teams have traditionally had to undergo a lengthy and fragmented internal troubleshooting process, as well as an external claims process with the clearing house that is also extremely time consuming and costly.

Why are these performance issues so tough to track down? Because there is a lack of behavioral transparency into end-to-end transactions. All it takes is one slow RDC application, process, or network to impact the end-user’s response time, leading to unhappy end-users, increased check processing risk and decreased productivity.

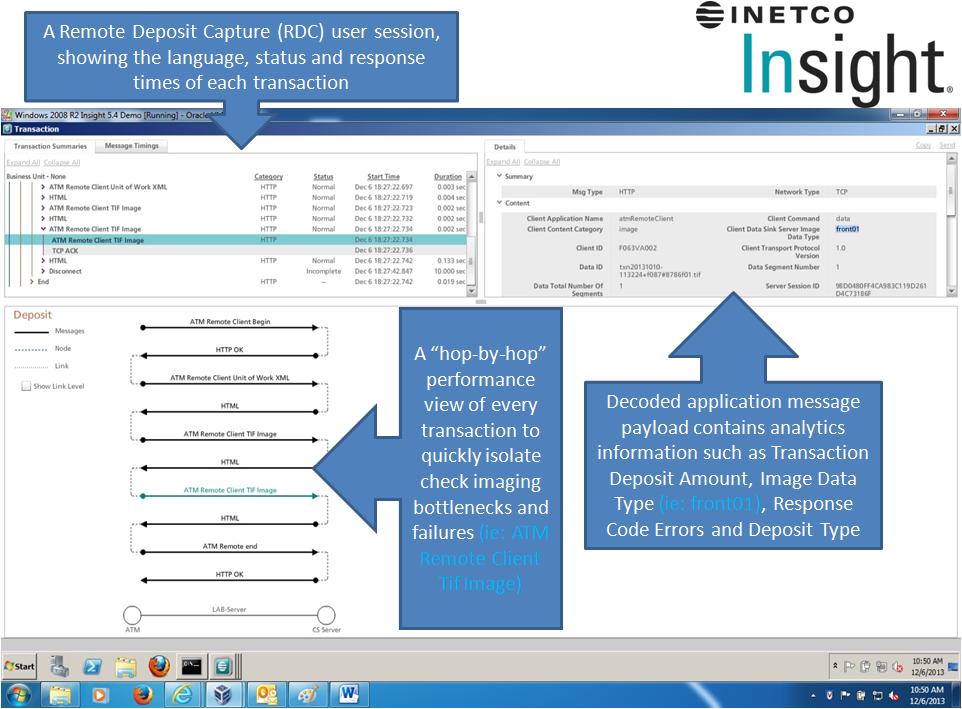

Now, imagine your financial institution had an easy way to capture, correlate and display every RDC transaction as it travelled over distributed networks including cellular networks, the Internet, the ACH network and your own internal network. What if you could also see a hop by hop breakdown of response times across check-image systems, remote deposit applications and core processing servers regardless of the language, framework or location – the information you need to quickly isolate when and why a Remote Deposit Capture (RDC) transaction is bottlenecked or failing?

Ka-Pow! We are talking actionable data and service delivery to the max.

The right transaction monitoring and analytics tools will give financial institutions the end-to-end transparency they need into both application and network performance, to easily see what actions are performed (or in the case of a failed transaction, what actions were not!). They will give you the powerful ability to analyze all your RDC transaction data in one place, gathered across mobile, online, merchant capture, ATM and branch channels. Decoded application message payload information will make it easy to report or alert in real-time on transaction data and metrics such as:

- Response code errors and messages

- Transaction dollar amounts that exceed deposit thresholds

- RDC transactions that are taking too long or failing

- The daily number of items being deposited per self-service device or terminal ID

transaction dollar volumes - The number of check image transactions failed due to poor image quality

Transaction transparency will enable banks and credit unions to:

- Support more successful RDC user experiences through real-time performance visibility into all critical user session transactions (including those that fail due to poor image capture or deposits over a certain deposit limit)

- Reduce number of ACH claims and check image reconciliation issues through improved end-to-end delivery of check image files

- Improve operational efficiency through real-time, multi-hop transaction visibility and faster isolation of RDC bottlenecks and failure points across all channels

- Leverage their transaction monitoring and analysis investment across multiple channels, RDC platforms and operations/support teams

- Mitigate sufficient fund and fraud risks associated with the clearing of RDC checks

The bottom-line results? Significant operational efficiency gains through improved data consolidation accessibility and 75% faster isolation of transaction performance issues, reduced risk of check reconciliation issues and costly exception-based processing, and improved customer service delivery across all RDC-enabled channels.

To find out how the INETCO Insight transaction monitoring software makes it easy for financial institutions to gain transparency into deposit transaction delivery systems and the processing of check deposits across multiple channels, contact us for a demo.