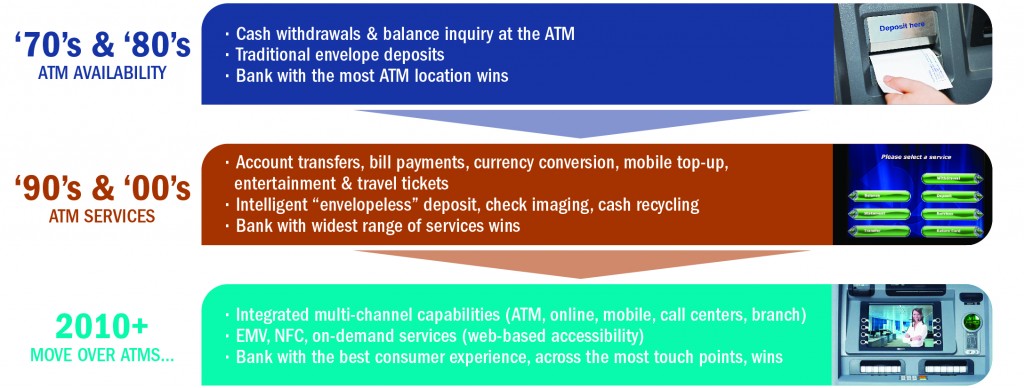

It was over four decades ago when the first consumer was able to perform a simple cash withdrawal transaction and balance enquiry at an ATM. The 90’s and into 2000 were mostly dedicated to adding services such as intelligent deposit, account transfers and bill payments. Vendors such as INETCO and NCR were just starting to realize the potential in offering ways to access advanced diagnostics, condition monitoring and alerting, and executive dashboards that made it easy to gain a snapshot into ATM management and network performance.

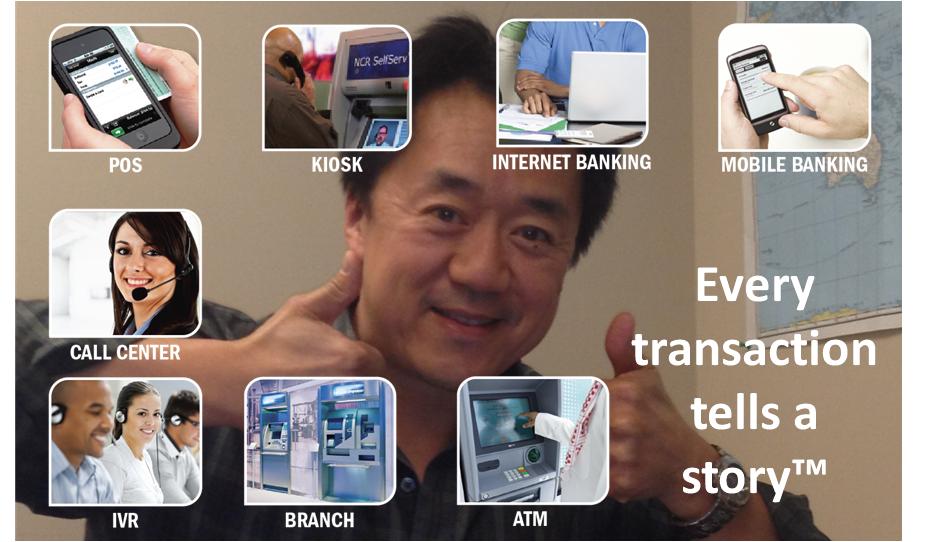

But what we have seen this past decade, in terms of technological innovation, has been mind blowing. Virtual channels have exploded due to high speed Internet, security advances and mobile accessibility. We have seen creative convergences between direct services offerings, multiple retail banking channels and personalized marketing campaigns. The majority of consumers interact through 3 of these channels or more, but still demand an “omnichannel” banking experience. Banks are increasingly providing a wider choice of self-service channels but their customers are still impatient for more.

Enterprise-wide performance awareness is about managing the unforeseen, the changes and the exceptions – in the most efficient and cost effective way possible. Once achieved, banks and financial institutions will have the power to raise the bar in terms of customer experience, operational efficiencies and IT investment leverage. Attaining this in ATM and multichannel banking environments starts with end-to-end visibility:

- Across all customer-focused devices and technology

- Across all cash points, channels and branches

- Across all transactions, service applications and network infrastructures

We want to make sure that you are ready to manage performance and consumer service across your increasingly complex ATM and multichannel banking networks. That is why NCR and INETCO are hosting this BAI Banking Strategies Webinar on Wednesday, November 20th at 1pm CST.

Join this interactive exchange to examine challenges and gain new insights on managing performance and consumer service across your ATM and multichannel banking environment. Explore how you can:

- Improve device management, transaction management and cash optimization in ATM and multichannel banking environments

- Gain easy access to holistic, real-time information on ATM status, cash tracking and transaction performance

- Establish a “one-stop” user interface through which you could interact with this data

Hear from a trio of industry specialists that will consider the challenges of device management, transaction management and cash optimization. Learn tips to improve your organization’s management of performance in an ATM and multichannel banking environment. Develop a better understanding of the synergies that can be achieved when a holistic enterprise approach is followed.

Thanks, and if there are any specific questions you would like answered during this webinar, please send them my way!

English

English French

French Portuguese

Portuguese Spanish

Spanish