Welcome to the final installment of our 3-part series featuring recommendations to help financial institutions (FIs) navigate the impact of COVID-19 on their payments business. While we have previously focused on providing tips around managing the surge in online and mobile transactions, as well as how to combat the increase in card-not-present fraud, this blog will focus on how to drive payments revenue and provide an exceptional customer experience.

Since COVID-19, we have seen explosive growth in digital and contactless payment transactions – making it clear that customers are changing their banking and buying behaviors. In order to increase customer engagement, acquire new customers and maximize card portfolio profitability, FI’s need the ability to conduct timely analysis into every customer interaction.

But harnessing the data you need – across multiple payment channels, card rails and disparate data stores – can be costly, time-consuming and resource-intensive. Payment data acquisition challenges often impact the ability of channel managers, customer experience teams and analysts to create interactive dashboards, continuously feed machine learning algorithms and produce payment analytics reports without a long lead time. And while it may seem obvious that FIs should be tracking every customer interaction, it’s not just about collecting endless amounts of data. It’s about providing the right data, at the right time to the teams and applications that need it most.

Here are some tips to consider when analyzing and forecasting payments revenue, card portfolio profitability and customer behavioral shifts of COVID-19:

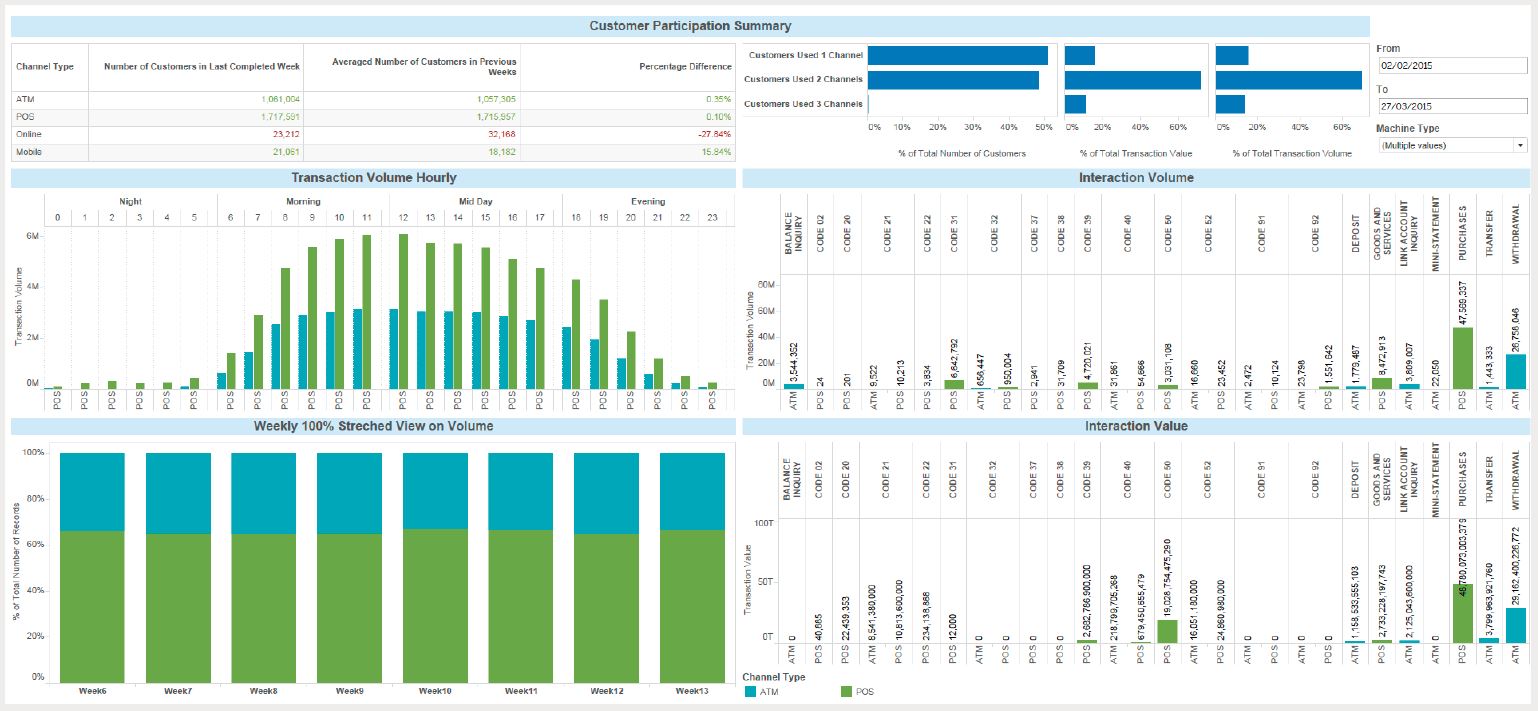

- Optimize the way payment data is collected, centrally stored and visualized – Invest in a real-time transaction data pipe and a scalable data storage cluster that helps you gain easy, on-demand access to “ready to analyze” data across all your payment channels.

- Use a fully decoded transaction data set to feed on-demand analytics — Establish on-demand access to detailed transaction data that can be fed into machine learning models, predictive algorithms and business intelligence tools such as Tableau, Microsoft Power BI or Jaspersoft. This includes information such as transaction types, amounts, response codes, payment rails, card types, terminal IDs, customer IDs, hashed PAN information, dates, statuses and message types.

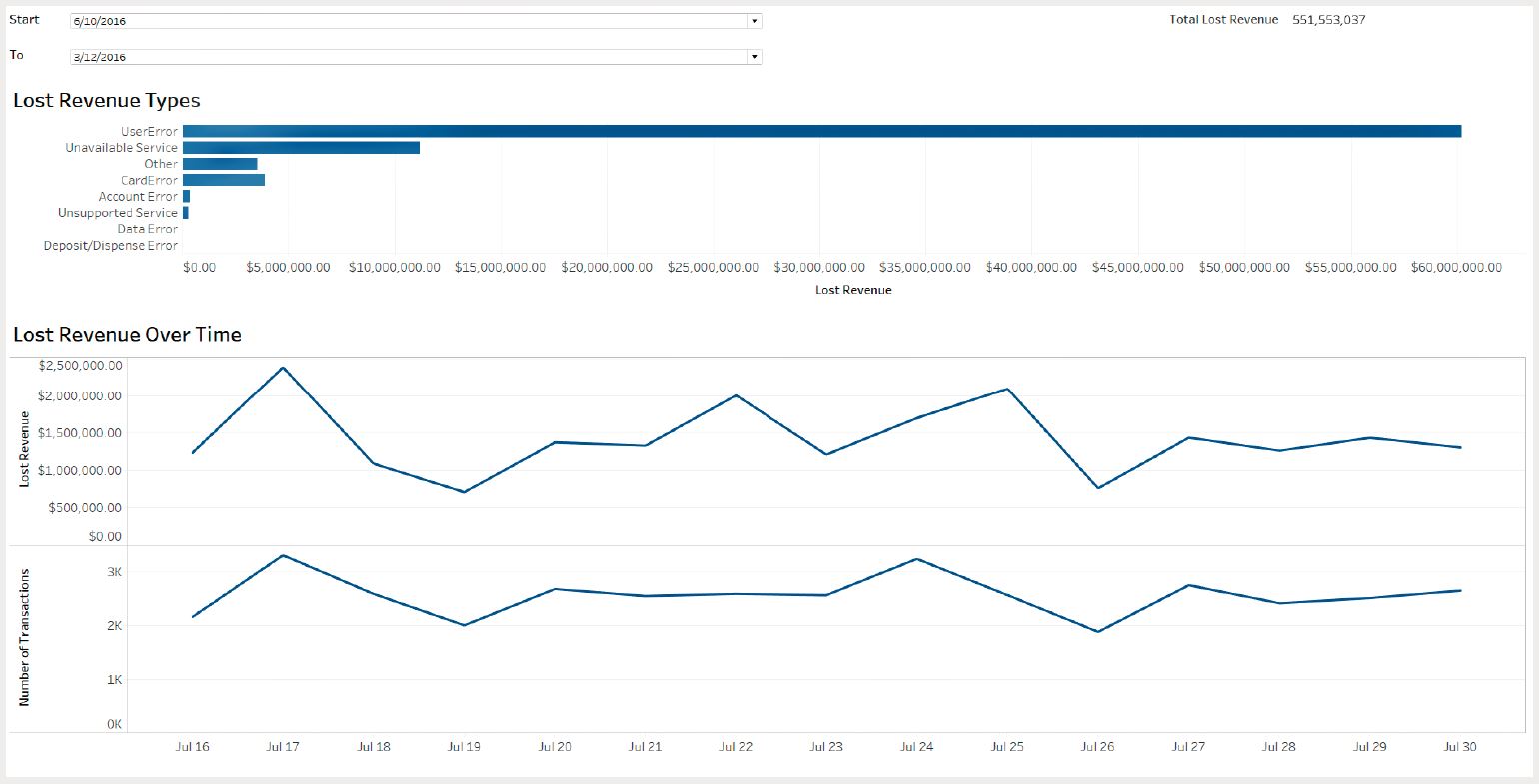

- Find ways to maximize payment revenues and card portfolio profitability — Analyze and forecast answers to revenue-related questions such as:

- Which issued cards are successfully activated within customer digital wallets?

- Where is my interchange revenue coming from?

- Which merchant sectors are growing, and which are declining?

- What are the reasons specific transactions have not completed?

- When are debit cards being used versus a credit card?

- Find ways to understand customer needs — Analyze and forecast answers to questions such as:

- Where does it make sense to increase limits of contactless cards and card-not-present transactions?

- Where are we seeing shifts in card usage patterns and the overall payment transaction mix? (ATMs, POS, Online, Mobile)

- What are the effects of waived or reduced card and account fees?

When reflecting on how this pandemic has impacted retail banks and credit unions, it is clear that COVID-19 has required FIs to:

- Prepare for the surge in digital payments and stimulus transactions

- Defend against new COVID-19 related payment fraud and cybersecurity attacks

- Understand the impacts of the coronavirus on payments revenue and customer behavior

Read the interview with BDC and learn how INETCO is uncorking payment bottlenecks during COVID-19.

By optimizing transaction performance, strengthening fraud detection, and evolving digital banking and card programs to meet new customer needs, FIs are creating stronger relationships that stand the test of time and provide the much needed foundation for future success. With the right combination of real-time transaction data acquisition, continuous monitoring and analytics, INETCO is in a unique position to help you navigate the impacts of COVID-19 while boosting organizational reputation and keeping customers happy.

To discuss how strengthen your payment ecosystems, contact us!

English

English French

French Portuguese

Portuguese Spanish

Spanish