It’s always nice to get recognition for a job well done. It’s even nicer when a customer such as TNS uses your technology and gets recognition as one of this year’s Best Merchant Acquirers/Processors!

It’s always nice to get recognition for a job well done. It’s even nicer when a customer such as TNS uses your technology and gets recognition as one of this year’s Best Merchant Acquirers/Processors!

This week FStech and Retail Systems announced their shortlist of candidates for their 2014 Payments Awards, which recognize payments excellence and technology innovation. What does a payment gateway service provider such as TNS have to do to become a finalist for this type of award? I’m glad you asked…

TNS specializes in secure and resilient transaction delivery and processing services used by many of the top acquirers and retailers around the world. Founded in 1990, TNS’ global expertise extends to more than 60 countries across Europe, the Americas, and the Asia Pacific regions. Through its broader payment solutions offering, TNS connects over a million merchants and retailers to the world’s leading banks, acquirers and processors, enabling secure, efficient, cost-effective delivery and processing of payments.

TNS continues to grow electronic transaction volumes through customer acquisition and new value added service offerings. This constant business growth has resulted in a more complex IT environment.

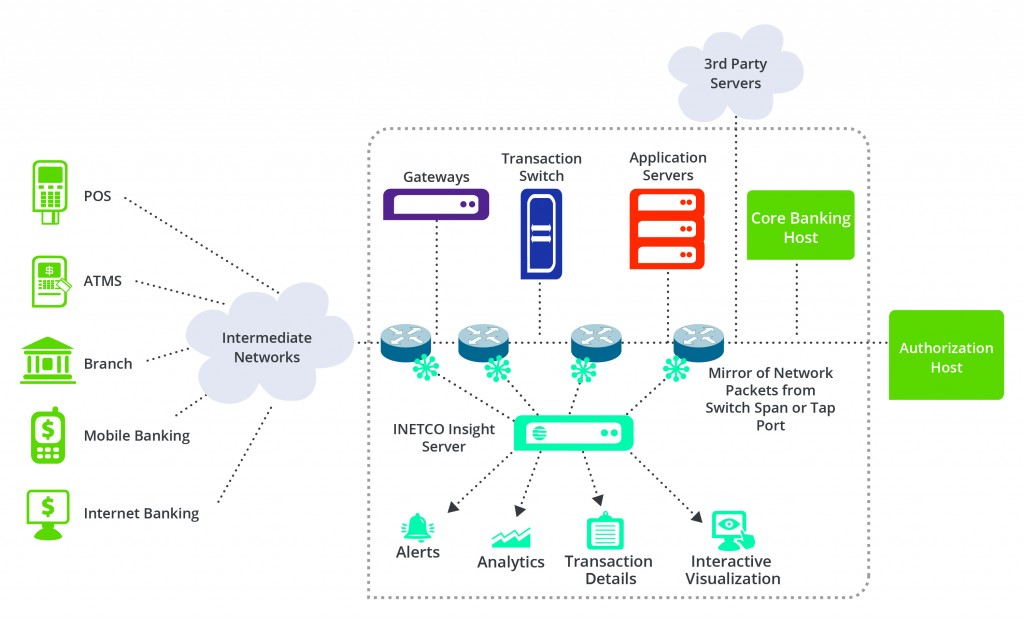

Committed to delivering an exceptional level of customer service, TNS deployed a cutting edge technology platform that combined end-to-end transaction profiling capabilities, application performance analytics and end-user experience monitoring for a comprehensive, enterprise-wide view into their dynamic IT environment. This way they could scale their business safely and proactively isolate terminal, network, application and third party performance issues before they affected the end customer experience.

In September 2013, TNS became the first payment processor in the UK to deploy the INETCO Insight real-time transaction monitoring and analytics platform to help them manage their complex and growing ACI Postilion payment processing environment. With a real-time transaction monitoring and analytics software solution, the TNS processing team gained up-to-the-second visibility into critical transactions running through their ACI Postilion switches, as well as instant notification on transaction slow downs, time-outs, and failures.

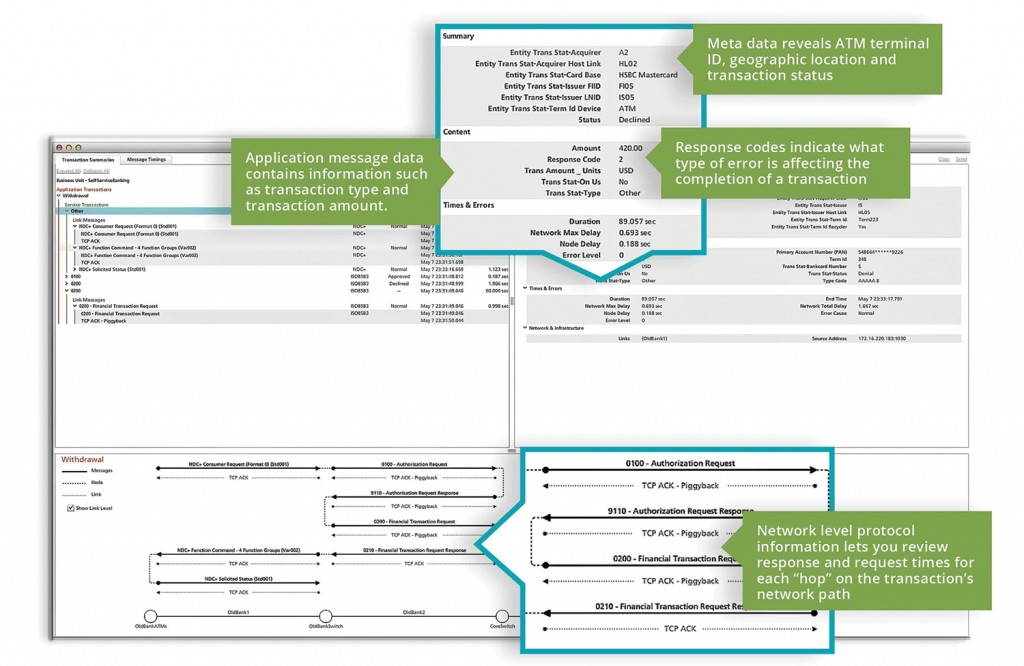

Rather than relying on technology that monitors only the transactions that make it to their Postilion switch, TNS has gained visibility into the entire transaction path (before and beyond the switch)—a one stop, enterprise-wide view into all critical consumer interactions. And this was all done without touching the switch or introducing intrusive agents, extra traffic loads and application changes that could negatively affect network performance. This innovative processor now has the tools to quickly drill down into any individual transaction, and obtain a “hop-by-hop” breakdown of device, application, ACI Postilion switch and network response timing data—all in one, easy to understand, view.

Project gains:

- BUSINESS SCALABILITY RISK-REDUCTION: TNS reduces the risk of service disruptions, deployment issues and availability issues with real-time performance visibility across the entire payment processing network

- PROACTIVE RESOLUTION: TNS reduces failed customer interactions through instant notification of transaction completion issues, application performance bottlenecks and network failures

- FASTER TROUBLESHOOTING: TNS investigates and resolves incomplete transactions that span a number of self-service channels, third party services, multi-vendor hardware and software applications (Note: other INETCO customers report an average of 65-75% faster problem isolation time)

- INCREASED PRODUCTIVITY: TNS reduces the time and operational resources tied up in problem isolation, data gathering and event correlation

- COST EFFECTIVE DATA MINING: TNS has an easy way to access the real-time and statistical transaction data needed to analyze both ATM and POS Terminal usage pattern trends to improve product, service and marketing business decisions

Ciaran Jones, Vice President of Operations for TNS, sums up the gains well:

“INETCO Insight empowers us to safely scale our ACI Postilion-based processing business, while continuing to fulfill our commitment to exceptional customer service delivery. INETCO helps us to focus on our core services and support our clients’ growth to help them increase their productivity.”

If you’re interested in learning more about how you can leverage real-time transaction monitoring and analytics to reduce troubleshooting time and operational costs, while improving customer experience and payment processing profitability (which is even more fun to experience than to say), download our latest whitepaper Evaluating ATM / POS Transaction Monitoring: A Hitchhiker’s Guide to the Galaxy of Solutions, or contact us to discuss your particular transaction monitoring needs.