With The Nilson Report projecting that global card fraud losses will reach $34.66 billion in 2022, it has become evident that financial institutions and payment processors are struggling to detect and prevent payment fraud attacks before experiencing major financial loss and customer dissatisfaction. In fact, after speaking with some of the world’s largest banks, retailers and payment processors, we knew there would never be a better time than now to unleash INETCO Insight 7.

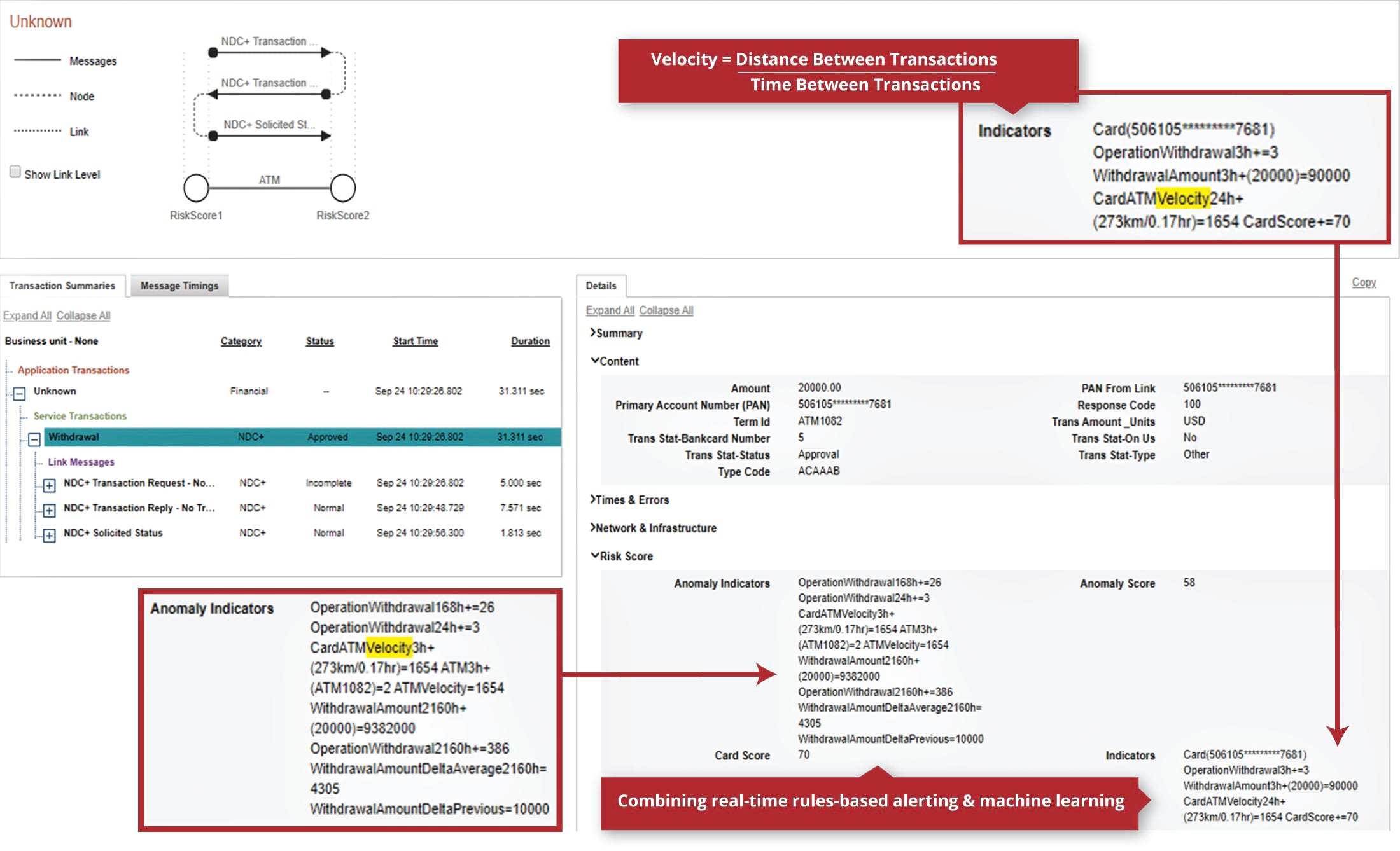

By combining real-time payment data acquisition, a highly configurable rules-based alerting engine and adaptive machine learning capabilities, INETCO Insight 7 features a fraud configuration designed for:

- Real-time suspicious activity monitoring, card-present fraud, card-not-present fraud & transaction reversal fraud

- Real-time detection of “man-in-the-middle” attacks, cash-out attacks & increased security of the payments switch

- Real-time transaction risk scoring, payment outlier detection & the blocking of offending card transactions at the IP or firewall level

INETCO Insight 7 independently audits the performance of real-time transactions from multiple points along the network, increasing the security of the payment-switching platform. Unlike many other fraud solutions that can take seconds, if not minutes to identify a potential fraud attack, INETCO Insight 7 can detect and prevent potential payment fraud attacks within milliseconds…. and here’s how!

The top 7 features of INETCO Insight 7 include:

- Out of band, network-based transaction data collection capabilities

- Centrally collect real-time transaction data across all card and payment channels without deploying agents, introducing delays, touching the switch or creating new points of potential failure

- Multi-point monitoring, transaction link correlation & profiling

- Independently audit the end-to-end journey of every transaction from the network in real-time, and immediately know when a transaction deviates from an expected path, or front-end IOS transaction is not married with a back-end database transaction (man-in-the-middle attack)

- Multi-protocol message decoding – All metadata, application payload, response/request times & network communications fields

- Quickly identify if any message field is being manipulated or tampered with; also utilize this rich transaction intelligence to feed adaptive machine learning algorithms and predictive analytics

- Real-time, configurable rules-based alerts engine

- Create a customized fraud alerts bundle based upon specific thresholds, payment outliers, fallbacks and other flagged transaction anomalies that require immediate investigation; add an independent layer of defense against fraud and switch system alerts that are overridden by malware

- Device state & switch state monitoring

- Showcase the location and status of each terminal or device, flagging potential security issues such as card reader tampering or safe opening without supervision

- Configurable real-time transaction risk scoring model

- Improve precision of real-time risk scoring by combining in depth transaction intelligence with real-time, rules based alerts and adaptive machine learning capabilities. Examine transaction in real-time, rebuild individual customer models on the fly, and extract behavioral patterns from past card transactions that signal potential fraud

- IP Address/Firewall blocking

- Receive immediate notification or set up automated action scripts to block offending card transactions at the IP address or firewall level. Immediately research flagged individual profiles and take action to reduce false negatives and positives

While INETCO Insight 7 is chalked full of great features, it is how it can truly benefit you that is most important. Here is a quick run-down of the top 5 benefits:

- Step up front-end fraud detection and reduce chargebacks – Identify and investigate suspicious payment transactions in milliseconds (including TRF, payment outliers, cash-out attacks, EMV chargebacks, etc.)

- Proactively identify emerging fraud indicators – Continuously feed machine learning models and rebuild them every time a customer event occurs

- Improve risk scoring precision and safely reduce the number of false positives – Minimize the amount of accidental account blockings of legitimate customers

- Independently audit the entire payment transaction journey and reduce financial loss – Reduce breaches to payment switches and internal malware attacks

- Reduce resource time and operating costs – Harness real-time data across disparate data stores, multiple schemas and different update frequencies

If you are interested in learning more about how INETCO Insight 7’s features can help you to detect and preventing payment fraud in real-time, join us on Tuesday, October 1st for a 45-minute deep dive into INETCO Insight 7, including a product demo and a lively Q&A. If you cannot make the webinar and would prefer to discuss how you could benefit from a real-time payment fraud detection and prevention solution, send me an email!

English

English French

French Portuguese

Portuguese Spanish

Spanish