It’s that time of year when our friends in the US start making their way to gather with family, to say thanks, and to put marshmallows on sweet potatoes(??). It’s also a time when retailers get excited, and payment processors without real time transaction monitoring nervous, for the biggest retail weekend of the year.

In 2013, 44.8 million consumers shopped on Thanksgiving Day, followed by 92.1 million on Black Friday. With over $50 billion (National Retail Federation: Thanksgiving Weekend Shopping by the Numbers) expected to be spent over this single weekend, you can be sure that there will be a lot of overheating debit and credit cards.

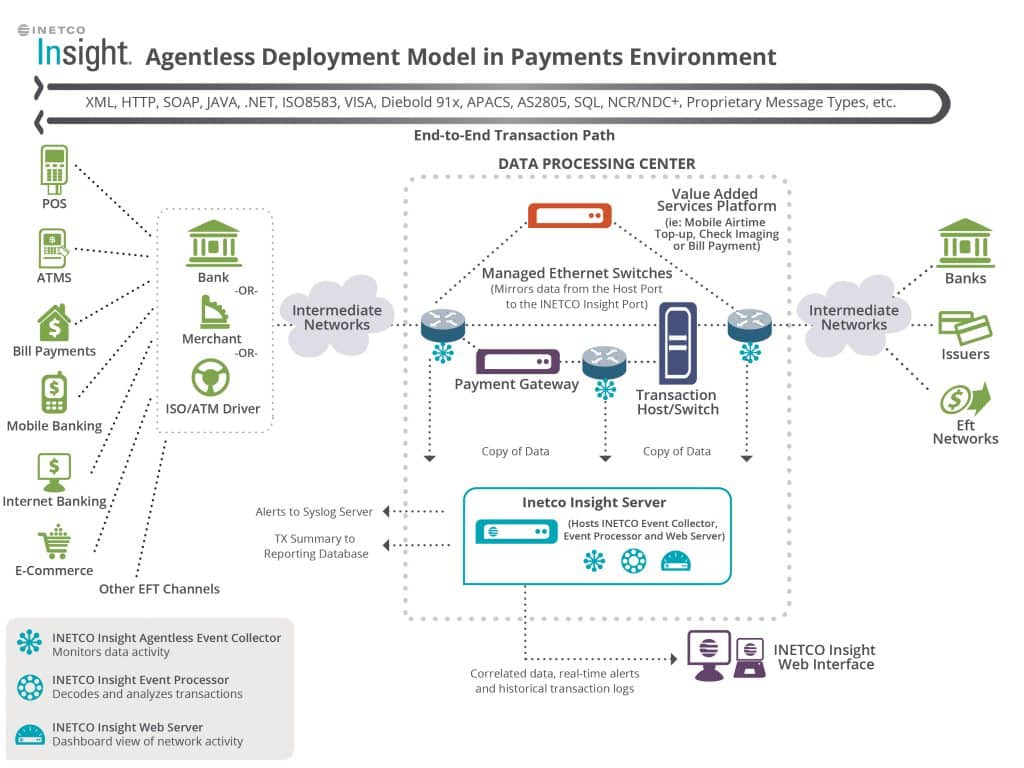

Now there’s a lot more to a completing a transaction than simply having a piece of plastic swiped (or chipped, or tapped, or tokened). Each transaction is actually made up of sub-transactions…many moving parts between a POS start point and a host authorization end point. These moving parts could include transaction switches, firewalls, service applications, or host security modules.

The thing is—the retailer doesn’t care, and shouldn’t need to. They expect that when Gary (not sure how I know the name…), who just waited in line for nine hours to save $500 on a giant flat-screen, goes to use his credit card (or phone, or chip embedded in his hand) that the system works. And if it doesn’t… well, “thank you,” is not what you as a payment processor will hear when the retailer calls to let you know…

So how do you stay on top of all of the sub-transactions to ensure that Gary is always able to buy his TV? Well, payment processors like FIS, Jack Henry & Associates, Moneris, and Open Solutions (Fiserv) use INETCO Insight real-time transaction monitoring.

These processors know that ensuring an amazing customer experience requires that they proactively identify transaction performance issues before they became large transaction failures. They understand that while component based application logs, network sniffers and trace technologies provide valuable information, it would take the IT operations team hours to correlate this information to isolate the root cause of transaction problems; hours that customers won’t wait, especially during a busy shopping season where each minute of downtime can result in millions of dollars in lost sales.

Using INETCO Insight real-time transaction monitoring, these processors receive custom alerts, set to warn them of issues before customer experience is affected. Because INETCO Insight captures and correlates all sub transactional data as it moves through each of its hops (from switch, to application server, to authorization host…), once an alert is made, within a few clicks, one member of the operations team (rather than multiple from disparate teams) can quickly ascertain exactly where and why a problem is occurring. The results: 50-75% faster mean time to repair, and 25% greater availability (see the case studies).

INETCO is thankful to have such great customers from the financial services industry who have shared their INETCO Insight success stories. To learn more about how your organization can benefit from real-time transaction monitoring and analytics, join us for the webinar: How to Meet Your Top 3 Consumer Engagement Resolutions.

Happy Thanksgiving from