Helping banks and credit unions strengthen their cybersecurity and manage the surge in mobile and digital banking transactions

Embracing digital service models and adopting convenient mobile and online payment applications is synonymous with expanding customer wallet share, leaning out payment processing costs, and reducing the risk of non-bank competition. As customers accelerate their shift to digital banking channels, steps must be taken to deliver the value, security and stability required for successful digital transformation.

INETCO helps banks and credit unions be ready for this new banking reality – in a cost effective way.

- Deepen customer engagement and usage of digital banking and payment applications.

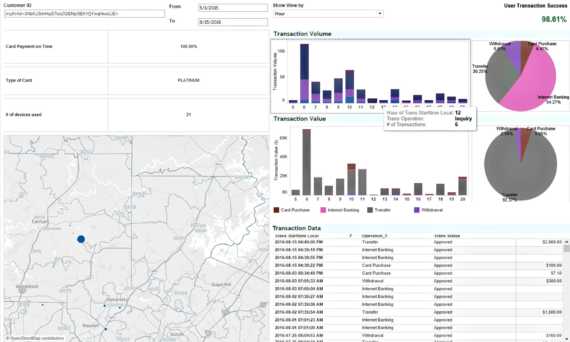

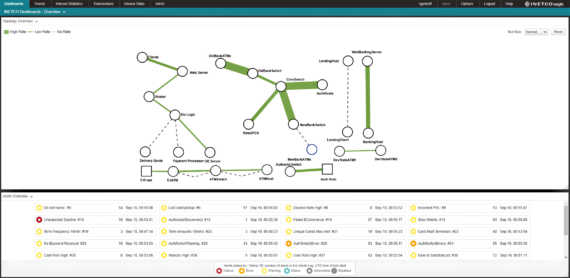

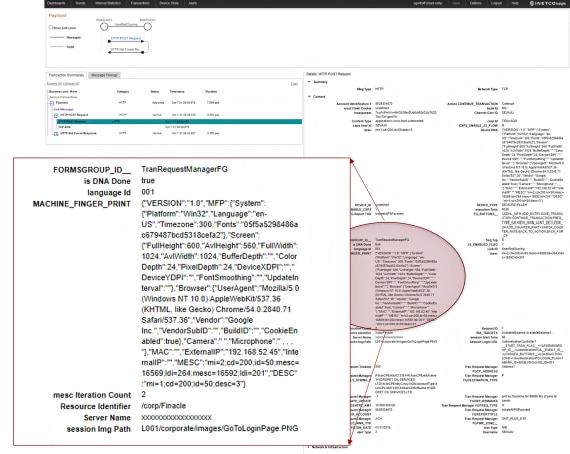

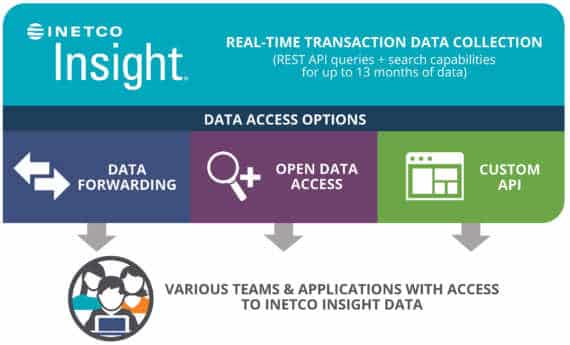

- Provide outstanding service performance and effectively manage the surge in mobile and online transactions.

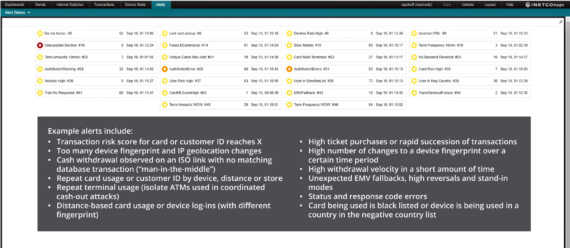

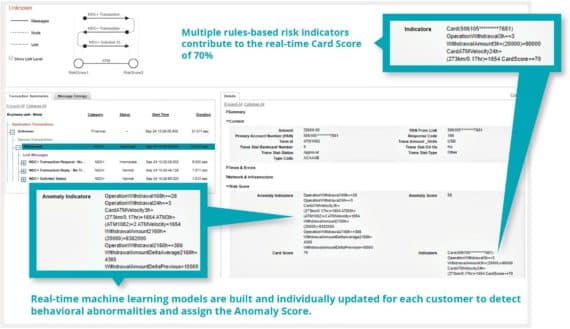

- Strengthen detection of payment fraud and cybersecurity attacks aimed at digital transactions.

English

English French

French Portuguese

Portuguese Spanish

Spanish