Helping banks and credit unions enhance the service delivery, security and analysis of faster payments

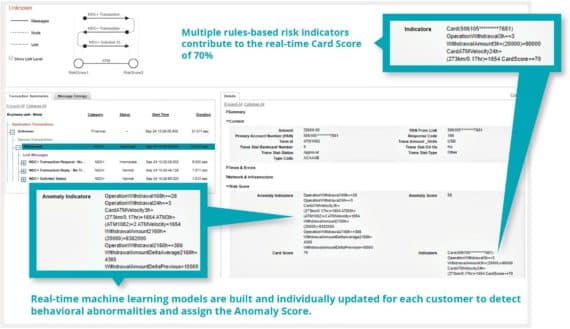

The adoption of a real time payments system is a high priority. But faster payment rails and settlement methods such as mobile wallets, push-to-card, contactless-enabled cards and API payments add more complexity when it comes to managing the end-to-end payment journey. With increasing payment speed and irrevocable payments services also comes a rising number of fraud attacks – a threat that is expected to grow as the time window for accurate risk assessment and authentication gets smaller and smaller.

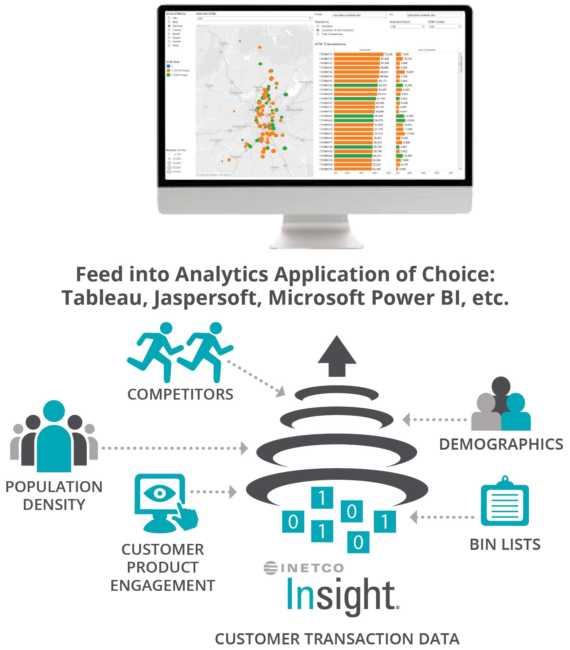

INETCO solutions provide the real-time decisioning tools and “always on” data visualization that banks and credit unions need to manage their real-time payments channel and meet customer expectations around security, availability and faster payments service.

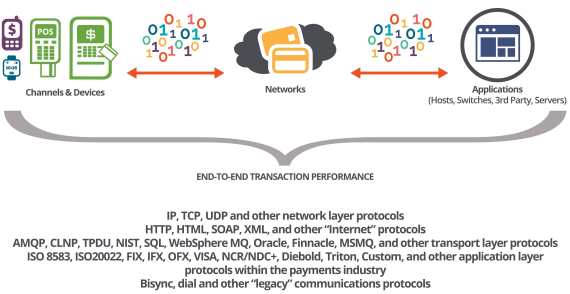

- Adopt ISO20022, implement real time payments rails and run new settlement methods without a hitch.

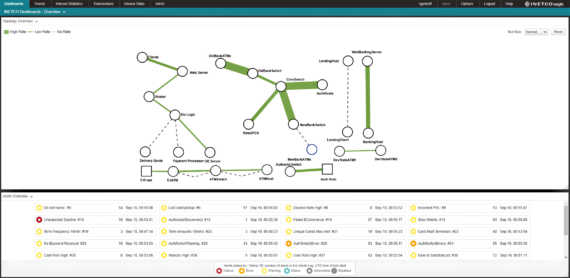

- Gain end-to-end visibility into every payment and isolate the root cause of real time payments bottlenecks, failures and unexpected declines ~85% faster.

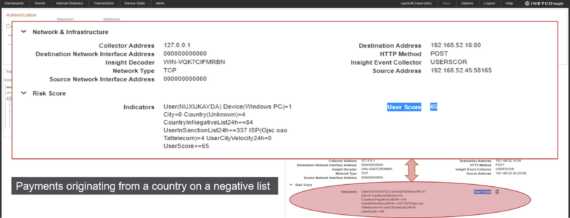

- Keep your organization and your customers safe from fraud – detect, investigate and block suspicious real-time payments activity in milliseconds.

English

English French

French Portuguese

Portuguese Spanish

Spanish