Over the past few months, we have seen retail financial institutions face mounting pressures to keep up with evolving self-service banking applications and meet consumer expectations around “on-demand” accessibility, consistency and choice. We have seen virtual channels explode due to high speed Internet, security advances and mobile accessibility. We have also seen creative convergences between direct services offerings, social media and personalized marketing campaigns.

So what does this all mean? It means that we are living and breathing a very cool self-service evolution. Integrated, multi-channel retail banking is a reality – presenting increasing operational risk…and endless revenue opportunity for those retail financial institutions that are “ready”.

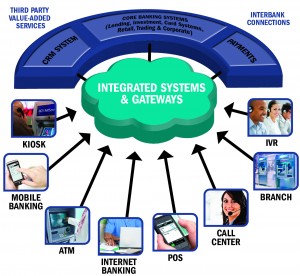

It also means that the most likely point of unexpected service latencies or transaction failures has shifted. In a multi-channel self-service delivery environment, most performance issues occur not in hardware devices (such as an ATM) whose technology is fairly mature, but in the handover of transactions from one IT hop (e.g. device, processor, core banking platform, third party service providers, back end connection) to another.

To be “ready” requires IT operations teams and channel delivery managers to have a combination of management solutions that can deal with both self-service device performance and end-to-end transaction performance. The powerful combination of device or ATM monitoring and transaction-centric application performance monitoring (APM) gives you complete, holistic visibility into your critical devices, service applications, consumer transactions and the underlying infrastructure they run on.

Recently noted by Jamal Abboud, Group CIO of National Bank of Abu Dhabi, “The ability to combine and analyze granular details on consumer transactions and ATM device statistics means we have maximum control over all the various services and payment options being provided through our ATM network and other banking channels. We can react in seconds – not hours – to what our end customers are experiencing.”

As the only transaction-centric application performance management software provider to specialize in the performance of self-service banking networks and applications, we decided to release a whitepaper on 5 recommended Best Practices when it comes to monitoring integrated, multi-channel retail banking environments. Our goal was to help today’s retail financial institutions to:

- Reduce consumer transaction failures

- Deliver seamless service integration across multiple channels and networks

- Improve communications between modern applications, third party connections and core banking systems

Key recommendations included:

1) Adopt real-time transaction monitoring across all your self-service delivery channels. Without monitoring the transactions themselves as opposed to the hardware or device systems, operators will be blind to slow downs or failures in transactions and unable to trace the source of the problem. Real-time transaction monitoring will enable you to provide consistent levels of service, spot consumer transaction issues as they emerge and become more proactive across all your integrated channels.

2) Monitor every transaction coming to and from your core banking system. Look beyond uptime and start using response times, usage patterns, and failed transactions as key metrics. These will help you to identify communication issues between modern applications and core banking systems, and isolate the source of any transaction slowdowns or failed consumer interactions on average 65% faster.

3) Use transaction-based monitoring and analytics to track the performance of external and internal service providers (e.g. 3rd party web services, bill payment systems, mobile top-up apps, managed hosting providers, core service providers, private cloud environments, co-location facilities, EFT and interbank connections). That way you can reduce blame storms and hold them accountable for their issues affecting the customer experience.

If you are interested in reading the whitepaper we have co-written with NCR, you can download it here.

We also invite you to join us for a 45 minute webinar on Wednesday, March 27th to learn more about transaction-centric application performance monitoring software and what these 5 practices will actually look like when implemented within a multi-channel banking environment.

So are you ready to lead the self-service evolution? Your feedback and thoughts would be most welcome!!